Download free excel templates as per United Kingdom (UK) VAT Act for maintaining the records of your sales during a specific period along with details of Output VAT collected on the sales.. This template for UK VAT is useful for personal and business use.

This template covers all legal compliances and legal provisions as per UK VAT Act. It is customizable as per the requirement. This template is useful to small and medium-sized businesses that don’t use any software for record-keeping.

About UK VAT Act

VAT Law in the United Kingdom (UK) is governed mainly by the Value Added Tax Act 1994 as amended by subsequent Finance Acts. But, there are many rules in Statutory Instruments. These are either orders made by the Treasury or regulations made by HMRC.

The Value-Added Tax Act provides for the taxation of the supply of goods and services and the importation of goods. This Act is applicable to all registered VAT vendors.

Requirement of Sales Register in a business

A sales register records sales and sales return to all customers of a business. It is also known as “sales ledger”. Usually, we record sales transactions. But in this register, we record transactions showing VAT computation.

To keep things simple, “VAT Sales Register” is the sales register with VAT information.

The VAT on sales of goods or services which a business collects is the Output Tax. Whenever you make any sales, you will have to collect VAT (as applicable) on the goods or services you supply.

According to the Record Keeping for VAT Notice 700/21, it is mandatory for the businesses to keep all your business records.

You will require this output tax figure at end of every tax period to calculate the VAT payable amount.

About VAT Sales Register

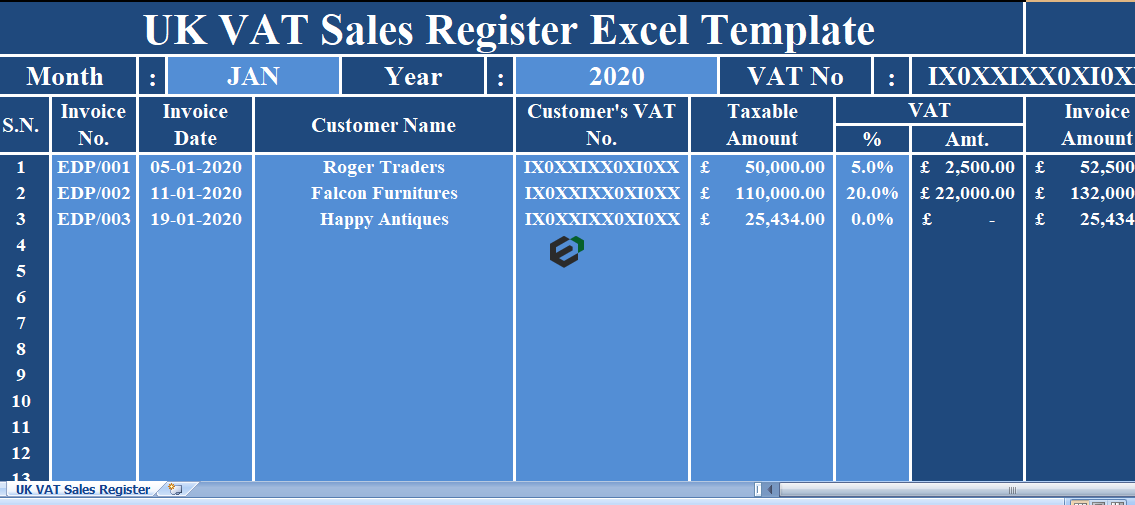

This simple and easy UK VAT Sales Register Excel Template comes with predefined formulae and formatting. You can easily record your VAT sales as well as sales return transactions. This template auto-calculates the VAT amount for given taxable value. Once you download this free excel template, you will find that Sales Ledger or Sales register consists of 2 sections, namely,

- Header Section and

- Sales Transaction Section.

1. Header Section

The header section consists of headings which include the company name, logo, and your VAT number.

This is a monthly sales report. You can record up to 100 transactions in this. Select the month from the dropdown list and enter respective year.

2. Sales Transaction Section

In Sales Transaction section, you need to record your sales and sales return transaction. It consists of following columns:

- Serial Number: Serial number is auto-generate hence you don’t need to make any entry in this column.

- Invoice No: Insert sales invoice or credit note number.

- Invoice Date: Enter date of the invoice.

- Customer Name: Enter name of your client/customer.

- Customer’s VAT No: Insert respective VAT number of your client/customer.

- Taxable Amount: Enter taxable amount of the invoice in this column.

- VAT Percentage (%): Select VAT percentage (%) from the dropdown list whichever is applicable 20%, 5%, or 0%.

- VAT Amount: This column consists of a predefined formula and hence requires no entry. The VAT amount is calculate using following formula: Taxable Amount X VAT %.

If you have multiple tax supplies in one invoice, insert entries separately against the same invoice number.

- Final Invoice Amount: Similar to previous column, this column also consists of predefine formula.

Final Invoice Amount = Taxable Value + VAT Amount.

At the end of entry section, final column totals are given. The first one is the taxable value, the second one is the Total Output Tax, and the third one is the total sales amount including VAT.

There is a provision to enter up to 100 invoices in the template. If you have more than 100 invoices, you can insert additional row as well. To maintain records for a longer time, either make a copy of this sheet and you can use it for other tax periods.

Download and Use UK VAT Sales Register in Excel

To use this free UK VAT Sales Register Template in excel, you should have Microsoft Office/ Microsoft Excel. You can only use this template if you have these applications in your system. or Use, Google Sheets.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.