Download this GST Credit Note Format in Excel and Spreadsheet for your Business. This template for GST India in Excel is useful for registered suppliers under GST regime. This is a printable credit note format in Excel.

If you are looking for Debit Note format in Excel under GST, you can find it easily at Excel Downloads.

Understanding Credit Notes under GST

Credit notes are defined in section 2(37) of the GST Law. A registered supplier has to issue a GST Credit Note format to his customer or receiver of goods and/or services when:

- The taxable value or the tax charged in the original invoice exceeds the taxable value or tax payable in accordance with such supply. In simple terms, if the previously issued invoice is over billed.

- The goods are returned by the customer against respective invoice.

This GST Credit Note in Excel follows the guidelines provided by the Government under Goods and Service Tax (GST) of India. It is helpful to issue the credit note to your clients against discrepancies in invoices issued earlier with relevant CGST, SGST, and IGST Computations.

Thus, It is very useful for all dealers, distributors, traders, wholesalers, accounts assistant, accountants etc.

About GST Credit Note Format in Excel

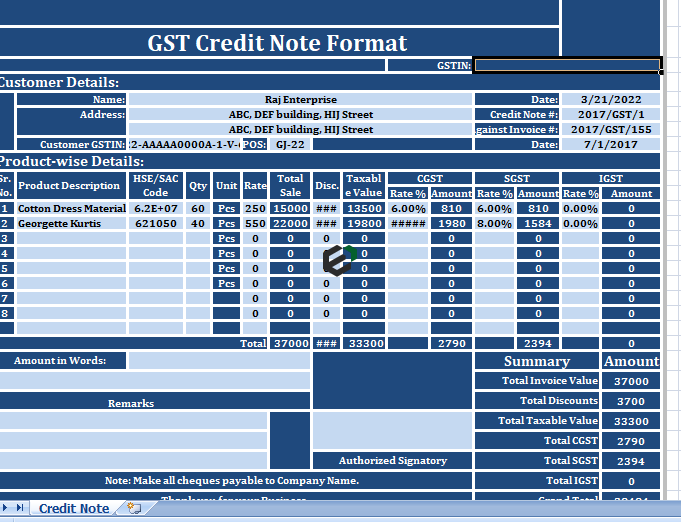

After downloading this GST Credit note format in excel, simply start by entering your company name, address, logo and start issuing the credit note. You will find four sections in this credit note format, namely,

- Header Section.

- Customer Details Section.

- Product and Tax Details Section.

- Summary and Signature Section.

1. Header Section

As usual, header section consists details like the company name, company address, company logo, GSTIN and the document heading “GST Credit Note”.

2. Customer Details Section

Additionally, In this section details of a customer such as the name of the customer, address, GSTIN, Credit Note Number, Place of Supply (POS), the date of issue, the invoice number and the invoice date against which the document is issued.

3. Product Details Section

So, Product and Tax section consists of columns similar to your Tax Invoice mention below:

- Sr. No.: Serial number of the products.

- Product Description: Product descriptions like color, size, dimensions etc.

- HSN/SAC Codes: HSN stands for Harmonized System Nomenclature code of Goods and SAC stands for Services Accounting Code of services.

- Moreover, It is mandatory to mention both in your every document under GST regime.

- Qty: Also Quantity of goods supplied.

- Units: Units.

- Rate: Rate of the product.

- The Total Sale: Auto calculated column. Total Sale = Quantity X Rate.

- Disc.: Discounts if applicable.

- Taxable Value: Taxable value of column is auto calculated. The Total Sale – Discount = Taxable Value.

- CGST: All the tax columns have 2 subdivisions. Rate of CGST applicable and the amount of CGST. The percentage rate is entered manually. This column is also auto calculate. Taxable Value X Rate of CGST.

- SGST and IGST: Similar to CGST, both SGST and IGST have same formats. The respective rates of SGST and IGST are enter manually and the Amount= Taxable Value X Rate of SGST/IGST.

- Note: When IGST is applicable, CGST and SGST will not be applicable.

- Totals: The total of each column for summary.

4. Summary and Signature Section

However, Summary and signature section consists of billing summary and their computations along with the signature box for authorized signatory, remarks, and business greetings.

Taxable Value = Total Invoice Value – Discounts.

Grand Total = Total Taxable value + CGST + SGST + IGST.

Format of a credit note in GST

Name, address, and GSTIN of the supplier. Nature of the document (Credit note, in this case), unique serial number (containing only letters and/or numbers), and date of issue. Name and address of the recipient. If the recipient is registered for GST, the note must include their GSTIN/UIN.

Thus, this excel template considers all the mandatory clauses and sections as per the rules.

Download and use GST Credit Note Format in Excel

To use this free GST CREDIT NOTE excel template, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template. You can customize the currency, color scheme, fields in this excel template as per your requirement.