Download GST Debit Note Format in Excel and Spreadsheet for your business and client. This GST Excel Template for debit note is useful for Traders, Wholesalers, Accounts Assistant, Accountants. This is a printable Debit note format in Excel.

GST implemented with effect from 1st July 2017. As a registered business will now have to issue GST Invoice for the supply of taxable goods or services. A GST Debit Note format whenever taxable value or tax charge in original invoice is found less than the actual amount.

If you are looking for Credit Note format in Excel under GST, you can find it easily at Excel Downloads.

Understanding Debit notes under Goods and Service Tax (GST)

A revised tax invoice refer in section 31 and credit note or debit note refer in section 34 is required under Goods and Service tax. As per Section 34 read with section 31, Debit note is to be raised must comply with the rules as below –

- Every registered person who has been granted registration with effect from date earlier than the date of issuance of certificate of registration to him may issue revised tax invoices in respect of taxable supplies.

- Any invoice or debit note issue in pursuance of any tax payable with the provisions of section 74 or section 129 or section 130 shall prominently contain the words “INPUT TAX CREDIT NOT ADMISSIBLE”.

This excel template for GST Debit Note follows the guidelines for debit notes and reverse invoicing as envisaged under Goods and Service Tax (GST).

Contents of the GST Debit Note Format

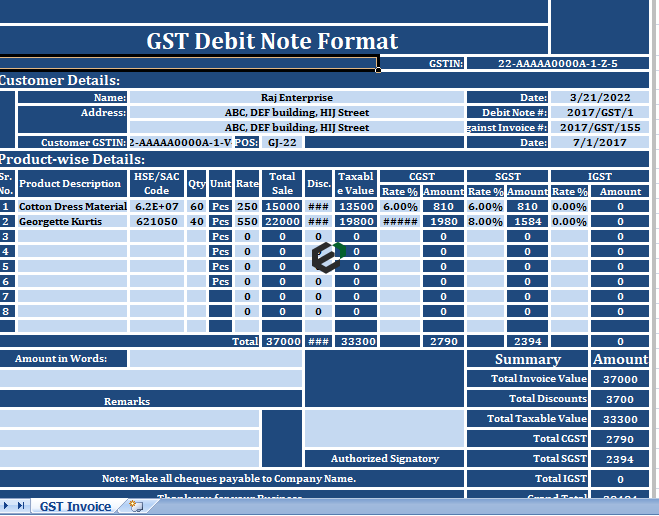

This GST Excel template is helpful to issue debit note against the invoices issued earlier with less tax value or tax amount to your clients with relevant CGST, SGST, and IGST Computations. Once you download this template, you will find four sections, This template has 4 sections

- Header Section.

- Customer Details Section.

- Product and Tax Details Section.

- Summary and Signature Section.

1. Header Section

The header section contains company name, company address, company logo, GSTIN and the heading “GST Debit Note”.

2. Customer Details Section

Customer Detail section consists the details of a customer such as the name of the customer, address, GSTIN, Debit Note Number, Place of Supply (POS), the date of issue, the invoice number and the invoice date against which the document is issue.

3. Product-wise Tax Details Section

Similar to your tax invoice this section also contains the same columns:

- Sr. No.: Serial number.

- Product Description: Size, color, dimensions, etc. of Product.

- HSN/SAC Codes: Harmonized System Nomenclature code of goods or Services Accounting Code of services.

- Qty: Quantity of goods.

- Units: Unit of the product

- Rate: Every product has a price per unit. Enter the rate of your product.

- Total Sale: This column is auto calculated where Total Sale = Quantity X Rate.

- Disc.: Applicable discount on goods or services

- Taxable Value: Taxable value is the amount in which the tax is applicable. This column is also auto calculate where Total Sale – Discount = Taxable Value.

- CGST: This column contains 2 subdivisions. The applicable rate of CGST and amount of CGST. The rate is enter manually. The Amount column of CGST is auto calculate. Taxable Value X Rate of CGST.

- SGST and IGST: Both these columns of tax have similar formats to CGST. The respective rates of SGST and IGST are enter manually and the Amount= Taxable Value X Rate of SGST/IGST.

- Note: When IGST is applicable, CGST and SGST will not collect.

- Total: A Horizontal total of each column for summary.

4. Summary and Signature Section

Summary and signature section contains billing amount payable by customer, signature box for authorized signatory, remarks and business greetings.

Total Taxable Value = Total Invoice Value – Discounts.

Grand Total = Total Taxable value + CGST + SGST + IGST.

Download and use GST DEBIT Note Format in Excel

To use this free GST DEBIT NOTE excel template, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template. You can customize the currency, color scheme, fields in this excel template as per your requirement.