Download Section 179 Deduction Calculator in Microsoft Excel and Spreadsheet. This template for Federal Income Tax helps to calculate the amount you can save on your tax bill by taking the Section 179 Deduction.

You just need to enter a few amounts and you will tentatively know that how much amount you could save on your tax bill. It is very simple and easy to use this calculator.

Understanding Section 179 Deduction

Section 179 of the U.S. internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable business equipment instead of capitalizing and depreciating the asset over a period of time. The Section 179 deduction can be taken if the piece of equipment is purchased or financed and the full amount of the purchase price is eligible for the deduction.

This initiative was taken by the government to encourage the small and medium size businesses to save money on the tax bill and use it for business enhancement.

Section 179 Deduction Limits for 2022

The Section 179 deduction limit for 2022 has been raised to $1,080,000. Your company is allowed to deduct the full cost of equipment (either new or used), up to $1,080,000, from 2022’s taxable business income.

Contents of Section 179 Deduction Calculator

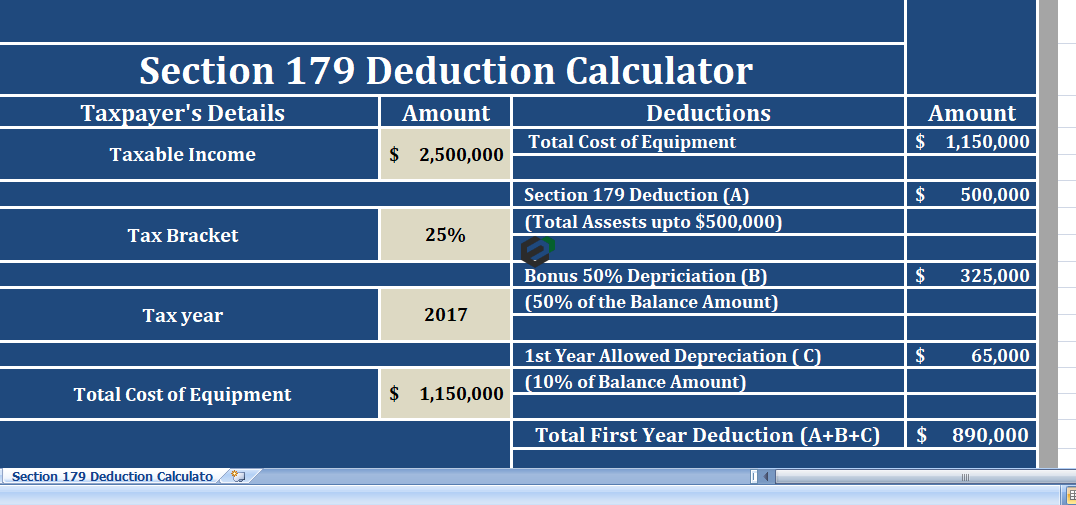

Post download this Section 179 Deduction Calculator, you will find two sections, namely –

- Taxpayer’s Details

- Section 179 Deductions

1. Tax Payer’s Details

Taxpayer’s section consists of the following:

- Taxable Income: Enter your taxable income in this cell. The purpose to provide taxable income here is that according to section 179 (b) (3), the deduction amount shall not exceed the aggregate amount of taxable income of taxpayer.

- Thus, if the deduction amount is above the taxable income then section 179 deduction will not be available.

- Tax bracket: You need to enter the tax bracket in the second cell on left. This will help calculate the amount you saved on tax.

- Tax year: Applicable Tax year. Please keep in mind the calculator is design according to the limits and threshold of the year 2017 for Section 179 deductions.

- Total Cost of Equipment: Enter the total cost of equipment for which you are planning to claim the Section 179 deduction.

2. Section 179 Deductions

When you have entered the above amounts in the taxpayer’s details section. Section 179 Deduction will calculate the total amount of the deduction.

Total Amount Of Deduction = Section 179 Deduction + Bonus Depreciation + Allowed Depreciation

Where:

- Section 179 Deduction = Cost of Equipment up to $ 5,00,00.

- Bonus Deduction = 50% of the Value left after deducting $ 500,000.

If the value of the equipment is less than $500,000. The bonus depreciation will not be available as the total value of the asset is shown as an expense.

- 1st year Allowed Depreciation = 10% of the balance amount remaining after deducting $ 500,000.

Similar to Bonus Depreciation, the first year depreciation is again not available if the amount is below $ 500,000 as the total value of the equipment has been written off as an expense.

If you want to learn more about section 179 deduction, you can read through the article on Investopedia.

Download and use Section 179 deduction calculator Excel Template

Now, let us look into how to use this Section 179 deduction calculator excel template. You should have Microsoft Office/ Microsoft Excel installed in your system.

Post installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template. You can change currency and fields but with caution.