Download free excel template for computing financial ratios and working capital for your business or client’s business. This template is useful for business managers, consultants and professionals, business leaders and students.

About Financial Ratios

As per Wikipedia, A financial ratio or accounting ratio is a relative magnitude of two selected numerical values taken from an enterprise’s financial statements. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization.

Examples of Financial Ratios

Now, let us understand some of the universally applied financial ratios that are computed by business leaders and consultants to understand the financial health of any business –

Liquidity Ratio

Liquidity ratios measure a company’s ability to pay off its short-term debts as they become due, using the company’s current or quick assets. Liquidity ratios include the current ratio, quick ratio, and working capital ratio.

Solvency Ratio

Also called financial leverage ratios, solvency ratios compare a company’s debt levels with its assets, equity, and earnings, to evaluate the likelihood of a company staying afloat over the long haul, by paying off its long-term debt as well as the interest on its debt. Examples of solvency ratios include: debt-equity ratios, debt-assets ratios, and interest coverage ratios.

Profitability Ratio

These ratios convey how well a company can generate profits from its operations. Profit margin, return on assets, return on equity, return on capital employed, and gross margin ratios are all examples of profitability ratios.

Efficiency Ratios

Also called activity ratios, efficiency ratios evaluate how efficiently a company uses its assets and liabilities to generate sales and maximize profits. Key efficiency ratios include: turnover ratio, inventory turnover, and days’ sales in inventory.

Coverage Ratios

Coverage ratios measure a company’s ability to make the interest payments and other obligations associated with its debts. Examples include the times interest earned ratio and the debt-service coverage ratio.

Working capital

Per Wikipedia, Working capital is a financial metric which represents operating liquidity available to a business, organisation, or other entity, including governmental entities. Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital.

About this excel template

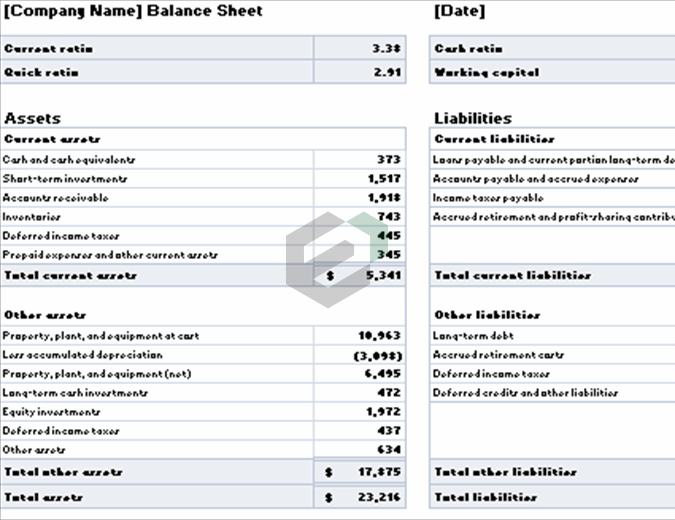

The Balance Sheet is a statement that shows the financial position of the business or an organization at any point of time. It records the assets and liabilities of the business at the end of the accounting period after the preparation of trading and profit and loss accounts.

This balance sheet template allows for tracking of assets and liabilities. Also, calculates several ratios based on those assets and liabilities. The computation happens automatically.

You can also explore other balance sheet templates available at Excel Downloads –

- Simple balance sheet format for small and medium business owners

- Blue balance sheet format downloadable excel template

- Financial Ratios and working capital computation Excel Template

- Balance sheet and ratios computation excel template

Download and use Financial Ratios and Working Capital Free Excel Template

To use this free excel template, you should have Microsoft Office/ Microsoft Excel installed in your system. After installing Excel or Spreadsheet, download the zip file of this template.

Extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.