Download free excel templates as per United Kingdom (UK) VAT Act for issuing a VAT compliant invoice in two different currencies.

This template is helpful to small and medium scale business people to issue VAT compliance invoices to their clients.

This template covers all legal compliances and legal provisions as per UK VAT Act. It is customizable as per the requirement. This template is useful to small and medium-sized businesses that don’t use any software for record-keeping.

About UK VAT Act

VAT Law in the United Kingdom (UK) is governed mainly by the Value Added Tax Act 1994 as amended by subsequent Finance Acts. But, there are many rules in Statutory Instruments. These are either orders made by the Treasury or regulations made by HMRC.

The Value-Added Tax Act provides for the taxation of the supply of goods and services and the importation of goods. This Act is applicable to all registered VAT vendors.

A dual currency invoice is prepare when the goods or services are supply from a foreign location or in foreign currency. It is mandatory by law to mention the tax amount in sterling with the applicable exchange rate.

About UK VAT Invoice with Dual Currency Excel Template

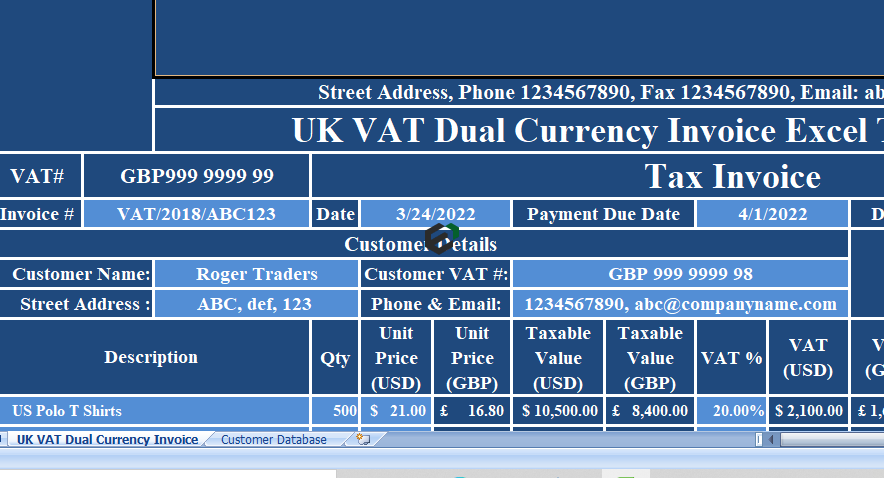

This UK VAT Dual Currency Invoice excel template comes with predefined formulae and conditional formatting. It will help you to issue the invoice with two or more currencies. By Default, One is Sterling Pound and another currency of other country whichever is applicable.

This Invoice template contains 2 worksheets, namely,

- UK VAT Dual Currency Invoice Template and

- Customer Database Sheet.

1. Customer Database Sheet

The customer sheet contains details of customers like company name, address, contact details, and VAT numbers, etc. The user just needs to enter the name only once in the sheet.

The customer sheet is link to the customer details section of the invoice template using data validation and VLOOKUP. Customer information can fetch on the invoice with the help from the dropdown list.

2. UK VAT Dual Currency Invoice Template

Now, in the UK VAT Invoice Sheet, it consists of 4 sections:

- Supplier Details,

- Customer Details,

- Product Details, and

- Some Other Details

a. Supplier Details (Your Company Details)

This section has your company name, address, logo, VAT registration number, and Invoice heading.

b. Customer Details

The customer detail section consists of the Invoice number, date of issue, payment due date, and number of days between the issue date and payment date.

You don’t have to type customer details in this section. It is pre-program using data validation and VLOOKUP function. Just select customer name from the dropdown list and it will automatically fetch all customer details such as an address, VAT number, and contact details.

As this invoice is in two different currencies, insert the currency conversion rate in the cell. In this template, we have taken USD as other currency and thus given the conversion rate. If you have any other currency, mention the currency’s alphabetical code and respective conversion rate.

c. Product Details

This section consists of the following columns:

- Description of Products

- Quantity

- Unit Price (USD)

- Unit Price (GBP)

- Taxable Value (USD)

- Taxable Value (GBP)

- Percentage of VAT

- VAT Amount (USD)

- VAT Amount (GBP)

- Line Total (USD)

- Line Total (GBP)

- Column Totals

Each of above columns calculates the GBP amount base on the conversion rate. Select the VAT percentage from dropdown list.

d. Other Details

Invoice Summary contains the totals of each column of product details section in both USD and GBP. Additionally, it consists of discount section. The template will automatically calculate the discount Rate and amount.

Lastly, it consists of Invoice Amount. The amount is calculated using this formula:

- Invoice Amount (GBP) = Taxable Value (GBP) + Total VAT Amount (GBP) – Discounts (GBP)

- Invoice Amount (USD) = Taxable Value (USD) + Total VAT Amount (USD) – Discounts (USD)

Moreover, it consists of “Amount in words” for both the currencies(GBP and USD). This cell auto-populates using Spell Number Function.

In addition to this, it consists of Terms & Conditions along with the space for company seal and authorized signatories. On the extreme left, it consists of the business greeting.

Download and Use UK VAT Invoice Format with Dual Currency in Excel

To use this free UK VAT Invoice Format with Dual Currency in excel, you should have Microsoft Office/ Microsoft Excel. You can only use this template if you have these applications in your system. or Use, Google Sheets.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.