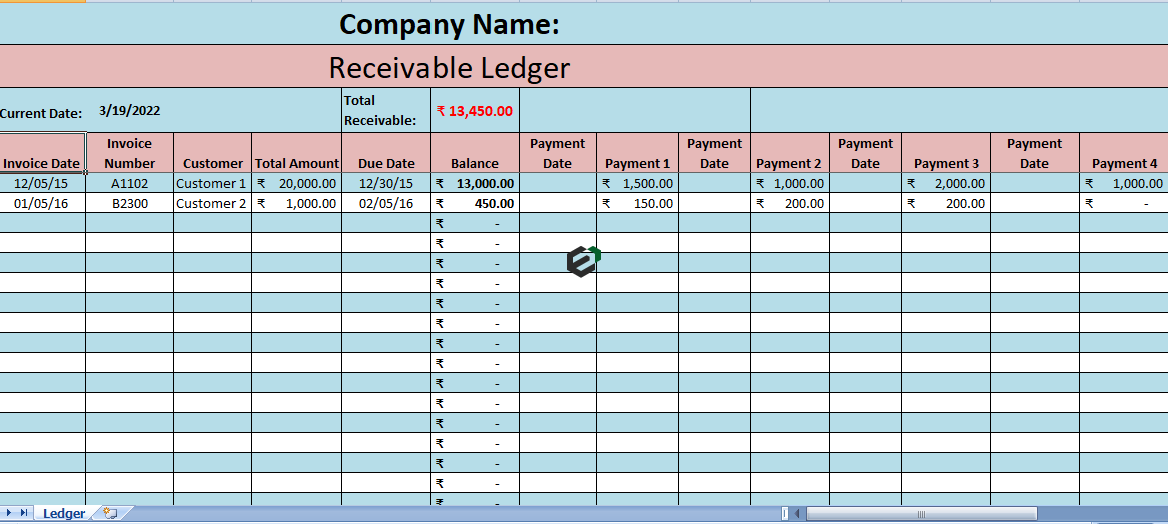

Download accounts receivable ledger format in Excel and Spreadsheet. You can use this template to Record date wise invoice and their respective payments.

The template shows invoice outstanding as well as total outstanding at given point of time. This template is also useful in managing customer invoices and payments.

Check out account receivable report with ageing analysis in excel by Excel Downloads.

Understanding Trade Receivable

Accounts receivable or trade receivable is a legally enforceable claim for payment held by a business for goods supplied or services rendered that customers have ordered but not paid for.

These are generally in the form of invoices raised by the business and delivered to customer for payment within an agreed time frame.

In simple terms, accounts receivable ledger consists of list of debtors to whom we have rendered a service or supplied goods. Moreover with details like invoice number, date of invoice, date wise payments received and outstanding receivables from a particular client or all in general.

Role of Accounts Receivable department

Accounts receivable department is an important department in any organization. It handles the following functions:

- Firstly, issue proper invoice against goods or services rendered.

- Secondly, record invoices in the respective customer account.

- Thirdly, Match the prices with Purchase order or Delivery Challan.

- Furthermore, Report mismatch if any or issue debit/credit note against it.

- Ensure timely collection of payment against invoices as per payment terms or contracts.

- Prepare the list of outstanding invoices that are due since long.

- Report settle invoices against all collection done.

- Reconcile invoices and payments statements between company and customer.

In addition to the above, this department also verifies purchases and prepares aging analysis reports apart from customer management.

What is a Receivable Process ?

Receivable process comes under revenue and revenue recognition business process. Typically, it is a four step process –

- Establishing the credit practices.

- Invoicing the customers.

- Tracking the Accounts Receivable.

- Accounting for Accounts Receivable.

Also, this department coordinates with the Sales department to ensure smooth collection of payments as well as saving the company from bad debts or long outstanding.

Journal entries for accounts receivable

With this template, just insert your company name at the top of the template. Start using the template. Additionally, you can record payments and also get the invoice-wise outstanding and total accounts receivable outstanding.

Furthermore, it consists of multiple payment columns against each invoice so that you can also record part payments against invoices. Now let us understand some basic accounting concepts and journal entries associated with accounts receivable and sales –

Journal Entries for Sales

- Account Receivable A/C – Debit

- To Sales A/C – Credit

Journal Entries For Payments Received

- Cash or Bank A/C – Debit

- Account Receivable A/C – Credit

Journal Entries For Payments Received With Discounts

- Cash or Bank A/C – Debit

- Sales Discount A/C – Debit

- Account Receivable A/C – Credit

The total of both credit amounts must be equal to the debit amount.

Journal Entries For Sales Return

- Sales Return A/C – Debit

- Accounts Receivable A/C – Credit

Download and Use Accounts receivable ledger Excel template

To use this free accounts receivable ledger format in excel, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template.