Download free excel templates as per United Kingdom (UK) VAT Act to issue a VAT compliant credit note when the goods are returned or an invoice is overbilled.

This template covers all legal compliances and legal provisions as per UK VAT Act. It is customizable as per the requirement. This template is useful to small and medium-sized businesses that don’t use any software for record-keeping.

About UK VAT Act

VAT Law in the United Kingdom (UK) is governed mainly by the Value Added Tax Act 1994 as amended by subsequent Finance Acts. But, there are many rules in Statutory Instruments. These are either orders made by the Treasury or regulations made by HMRC.

The Value-Added Tax Act provides for the taxation of the supply of goods and services and the importation of goods. This Act is applicable to all registered VAT vendors.

What is a Credit Note ?

A Credit note is a document that “supplier” issues to their customer for a reduction in invoice or discount in the price on the original VAT invoice. Goods return or reduction in billing amount reduces tax liability as the goods or services supplied have been reduced by the amount.

Contents of UK VAT Credit Note Excel Template

This template has 2 sheets:

- UK VAT Credit Note Template and

- Customer Database Sheet.

1. Customer Database Sheet

The customer database sheet consists of customer details as customer id, customer name, customer address, customer phone, Customer VAT number, and customer email address.

The purpose of creating this sheet to save time and simplify your work. You need to update the database sheet once with the customer details as per requirement.

Furthermore, a drop-down is created using the data validation function. When you select the customer name, the customer section fetches all relevant details using VLOOKUP function.

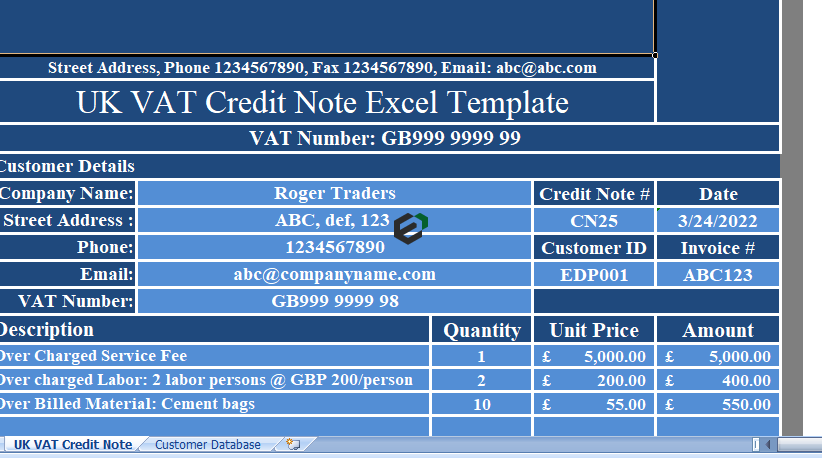

2. UK VAT Credit Note Template

Credit Note Template consists of 4 sections:

- Supplier Details,

- Customer Details,

- Credit Note Details, and

- Other Detail.

a. Supplier Detail

Supplier Details Section consists of the company name, logo, address and VAT number.

b. Customer Detail

Customer detail section consists of the following details:

- Company Name

- Street Address

- Phone

- VAT Number

- Credit Note Number

- Date

- Customer ID

- Invoice Number

As already discussed, this section is interlink with data validation and the VLOOKUP function to the database sheet. Just select the name of customer and this section is filled automatically.

c. Credit Note Details

Insert the details of goods return or overbilling. This section consists of columns that are Description, Quantity, Unit Price and Amount. In the end, there is subtotal line.

Amount = Quantity X Unit Price.

d. Other Detail

Other details section consists following:

- Also, Amount in words: It automatically convert the amount in words using Spell Number GBP.

- Terms & Conditions: Insert your credit note with terms and conditions.

- VAT computation: So, Insert the VAT percentage manually. The VAT amount is calculate on the percentage.

- Taxable Amount X VAT % = VAT Amount

- VAT Amount + Taxable Amount = Final Invoice Amount

- Company seal: Moreover, After printing invoice you can stamp the invoice with a company seal.

- Signature: Sign the invoice after printing the invoice by authorize personnel.

- Thank You Note: Insert a thank you note of your choice here.

Download and Use UK VAT Credit Note Format in Excel

To use this free UK VAT Credit Note Format in excel, you should have Microsoft Office/ Microsoft Excel. You can only use this template if you have these applications in your system. or Use, Google Sheets.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.