Download free excel template to track investments in Forex (PAMM) Percentage Allocation Management Module. This is also known as percentage allocation money management (PAMM). This template in excel is helpful for traders and fund managers and investors.

PAMM accounts are a simple hassle-free method for individuals to pick and choose their money managers for forex trading. Here, Investors benefit from profits with minimal involvement. However, PAMM accounts also carry the risks of capital loss, based on a money manager’s performance.

Understanding PAMM Account

Percentage allocation management module, also known as percentage allocation money management or PAMM, is a form of pooled money forex trading account. Here, an investor gets to allocate their money in desired proportion to the qualified trader(s)/money manager(s) of their choice.

These traders/managers may manage multiple forex trading accounts using their own capital and such pooled moneys, with an aim to generate profits for everyone.

Participants in a PAMM Account

The participants in a percentage allocation management module (PAMM) account are as follows –

- Forex broker/ forex brokerage firm

- Trader(s)/ money manager(s)

- Investor(s)

Note : If you want to learn more about PAMM Account along with examples, we recommend Investopedia Blog Post on PAMM Account.

Role of Forex Broker in PAMM Account

As we already know, Forex Broker is a participant in the PAMM Account. Now, Let us understand the role of forex broker in the whole module –

- Provide a secure, reliable platform that allows money managers and investors to interact

- Facilitate the trading activities of money managers within the realms of allowed regulations

- Facilitate the account keeping, deposits, withdrawal, and related activities

- Apart from a usual trading business platform, allow transparent review, feedback, rating, and related mechanisms for investors and money managers to select and interact with each other

How to select the the best money managers ?

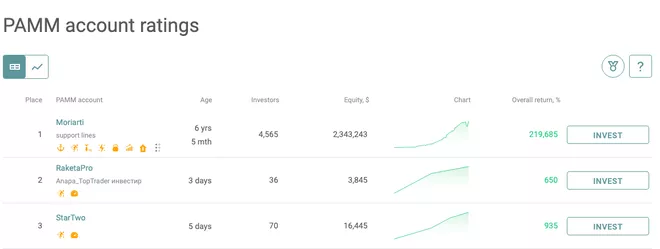

Brokerage firms offer numerous way for investors to make an informed choice, including detailed CVs, qualifications, past performances in terms of returns, amount of money managed, numbers of associated investors, positive/negative reviews, etc. about their traders/ money managers. In addition, there are outside rating systems. Here is a screenshot from Alpari’s PAMM account rating system:

About Forex PAMM Investment Tracking Excel Template

Now that we know a bit about PAMM Account, let us understand how this excel template for investment tracking can be helpful. Basically, this template is for emerging money managers and investors to track benefits from any PAMM Account.

You can create separate files for different accounts. Once you download this template file in Excel Format, you will find that it comes with only one sheet and it is easy to update.

You will find fields to update the following information :

- Money managers information

- Trader’s Charges/ Profit %

- Trading terms

- Amount investment

- Pool Profit or Loss Amount

- Trader’s charges

- Cash out.

Note : Fields in Grey area/ cells with grey color automatically updates based on your information in initial columns. This is an easy to use template for tracking investments in PAMM Accounts.

Download and Use Forex PAMM Account Investment tracker in Excel

To use this free Forex PAMM Account Investment Tracker Format in excel, you should have Microsoft Office/ Microsoft Excel. You can only use this template if you have these applications in your system. or Use, Google Sheets.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.