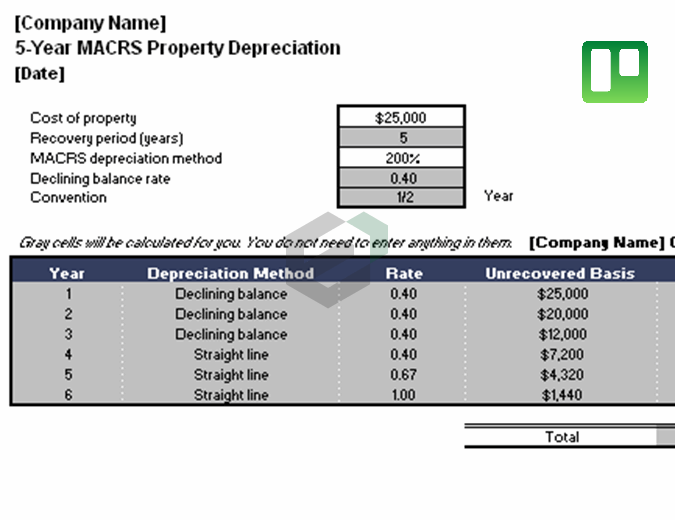

This MACRS depreciation calculator template is designed to help accountants and other financial professionals calculate tax depreciation for assets that fall under modified accelerated cost recovery system (MACRS) rules. The MACRS depreciation template calculates both 5-year depreciation and 7-year depreciation.

What is Modified Accelerated Cost Recovery System (MACRS) ?

The modified accelerated cost recovery system (MACRS) is a depreciation system used for tax purposes in the U.S. MACRS depreciation allows the capitalized cost of an asset to be recovered over a specified period via annual deductions. The MACRS system puts fixed assets into classes that have set depreciation periods.

Understanding the Modified Accelerated Cost Recovery System (MACRS)

As defined by the Internal Revenue Service (IRS), depreciation is an income tax deduction that allows a business to recover the cost basis of certain property. Deprecation is an annual allowance for the wear and tear, deterioration, or obsolescence of property. Most tangible assets are depreciable. Likewise, certain intangible assets, such as patents and copyrights, are depreciable.

Types of Modified Accelerated Cost Recovery Systems (MACRS)

There are two key MACRS deprecation systems. The first is the general depreciation system (GDS), while the second is the alternative depreciation system (ADS). These two systems have different recovery periods and depreciation methods. For the most part, GDS is used, although in special cases ADS can be used.

The GDS is best used for assets that depreciate quickly, such as computers and other technology. Meanwhile, the ADS must be used in certain instances, such as property used in a farming business, property that is exempt from taxation, or any property used outside the U.S. ADS must also be used for any listed property used 50% or less in a business during the tax year.

Now, businesses can elect to use ADS (instead of GDS). The election must cover all property in the same property class, and once made, that election can never be changed.

Source : Investopedia