Download free excel templates as per United Kingdom (UK) VAT Act for computing taxable turnover. This template for UK VAT is useful for personal and business use. This template covers all legal compliances and legal provisions as per UK VAT Act. It is customizable as per the requirement.

About UK VAT Act

VAT Law in the United Kingdom (UK) is governed mainly by the Value Added Tax Act 1994 as amended by subsequent Finance Acts. But, there are many rules in Statutory Instruments. These are either orders made by the Treasury or regulations made by HMRC.

The Value-Added Tax Act provides for the taxation of the supply of goods and services and the importation of goods. This Act is applicable to all registered VAT vendors.

Taxable Turnover under UK VAT Act

As per Government Website of UK, The VAT registration and deregistration thresholds will not change for 2 years from 1 April 2020.

The taxable turnover threshold which determines whether a person must be registered for VAT, will remain at £85,000. The taxable turnover threshold which determines whether a person may apply for deregistration will remain at £83,000. (Read More UK VAT Turnover Threshold Update)

Inclusions while computing Total Turnover

As per the UK VAT Registration Guide, to check whether or not your sales have exceed the threshold in any 12 months, you need to add total value of your sales made in UK apart from VAT exempt sales.

It includes –

- goods you hire or loan to customers,

- business goods use for personal reasons,

- goods you barter,

- part-exchange or gave as gifts.

However, It also includes services your business has received from businesses in other countries that are subject to Reverse Charge and construction of building above £ 100,000 done for own business by itself.

Sales made under zero-rated items are also include in taxable turnover. Only, VAT-exempt sales and goods or services you supply outside UK will be excluded.

About UK VAT Taxable Turnover Calculator Excel Template

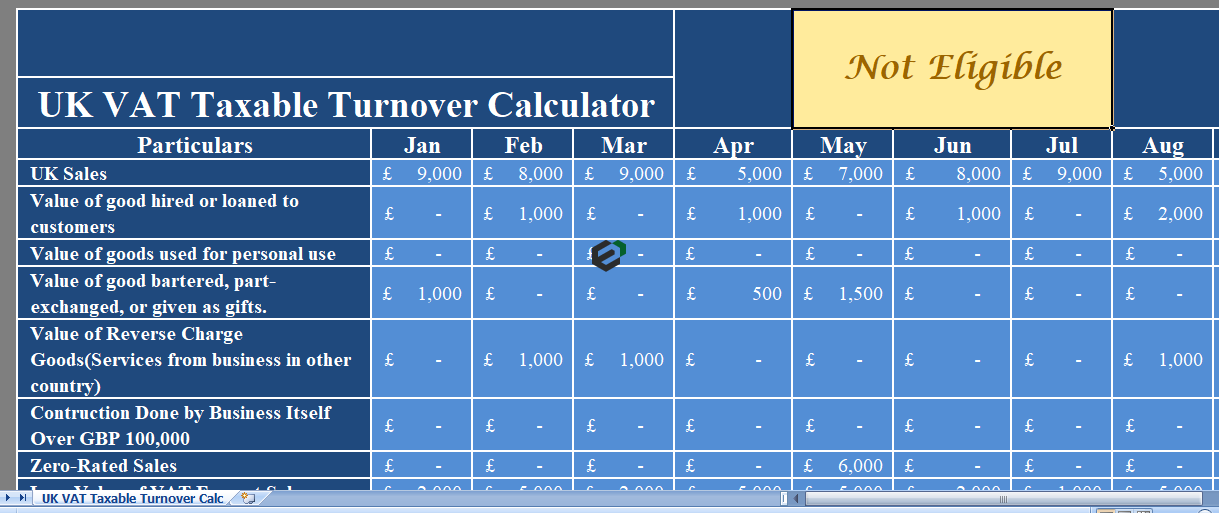

This template for UK VAT Turnover computation helps you simplify the process. You can know your eligibility for registration under UK VAT Act in minutes. Simply, start by entering respective sales for each month and the template will automatically calculate the total turnover during past 12 months. Once you download this template, you will see that this template consists of 3 sections, namely,

- Header Section,

- Type of Sales, and

- Monthly Sales.

1. Header Section

The header section consists of heading of the template, company name, and company logo. Furthermore, it also consists of the registration indicator beside the heading.

If the total taxable turnover is above the threshold limit, it will display “Register” in red and if the taxable turnover is below the threshold then it displays “Not Eligible” in Yellow.

2. Type of Sales

This section consists of column headings for every type of sale to be included in the taxable turnover. It consists of following:

- UK Sales

- The Value of good hired or loaned to customers

- Value of goods used for personal use

- The Value of good bartered, part-exchanged, or given as gifts.

- Value of Reverse Charge Goods(Services from business in another country)

- Construction Done by Business Itself Over GBP 100,000

- Zero-Rated Sales

After adding the above, deduct VAT Exempt Sales for each month respectively to derive the actual taxable turnover figure. Please make sure you include sales made inside the UK in all categories.

3. Monthly Sales

- Insert month-wise sales applicable under each type and template will automatically do the remain for you.

- In the end, line totals and column totals for each month and each type of sales are given in the template. As soon as your sales will reach £ 85,000, it indicates to register. Till then the indicator will display you are not eligible for registration.

Download and Use UK VAT Taxable Turnover Calculator in Excel

To use this free UK VAT Turnover Calculator Template in excel, you should have Microsoft Office/ Microsoft Excel. You can only use this template if you have these applications in your system. or Use, Google Sheets.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.