Download VAT Credit Note for GCC template in Microsoft Excel and Spreadsheet. You can use this Excel UAE Template for GCC Countries to issue VAT compliant credit note to your customers.

What is a credit note ?

As per the accounting rules, a credit note is a document then supplier issues in case of overbilling or return of goods against a particular invoice. Thus, all businesses processes and accounting systems have to be VAT compliant.

Goods return or reductions in billing decrease the VAT liability of a business. This is because the goods or services supply have reduce by that amount. This not only happens for VAT but other taxes like GST etc.

What are GCC Countries ?

The Cooperation Council for the Arab States of the Gulf, also known as the Gulf Cooperation Council, is a regional, intergovernmental, political, and economic union that consists of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. Thus, this template for VAT Credit Note in Excel is useful for countries highlighted above.

In this excel template, just select your desire country and it will automatically change the currency according to your select country. This template can be useful to retailers, wholesalers, accountants, freelancers, accounts assistants.

When you select your country, the system will automatically change relevant currency in the template. You don’t have to change it manually.

About VAT Credit Note Excel Template

Once you download this template, you will find two sections, namely,

- VAT Credit Note

- Customer Sheet

1. Customer Sheet

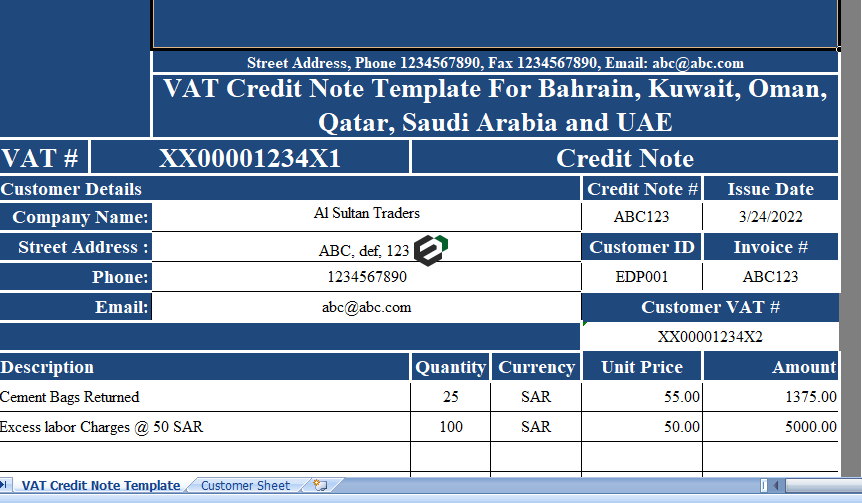

It contains the following columns for details of customers:

- Name

- Address,

- Phone

- Email address

- Customer ID

- VAT number

2. VAT Credit Note Template

The Template consists of 4 sections:

- Header Section

- Customer Details Section

- Product Details Section

- Other Details Section

1. Header Section

The Header section consists of the company logo, company name, address, company’s VAT number and heading as “Credit Note”.

2. Customer Details Section

So, Data validation creates the drop-down list from which you can select the customer name. Other customer details will be automatically updated in customer section with the help of VLOOKUP.

In addition to the above, the customer details section consists of the Credit note number, Credit Note date, and Invoice Number against which the Credit note is issued.

3. Product Details Section

Moreover, A user needs to enter the details of products returned, their unit price etc.

The total invoice amount is calculated using the below formula:

Quantity X Unit Price = Amount.

Furthermore, there is a subtotal line below the amounts which makes the total of above line using the SUM Function.

4. Other Details Section

Other details section consists the VAT computations, Total Invoice Amount, Amount in Words and Terms & Conditions.

Apart from that, this section contains the Thank You greeting, Company seal and Authorized Signatory

So, The VAT computations have been configured with redefined formulas. Thus, it will automatically calculate the VAT amount on the total amount of the bill.

Amount = Subtotal Amount X VAT Percentage.

Download and use VAT Credit Note Excel template for GCC

To use this free GCC VAT CREDIT NOTE excel template, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template. You can customize the currency, color scheme, fields in this excel template as per your requirement.