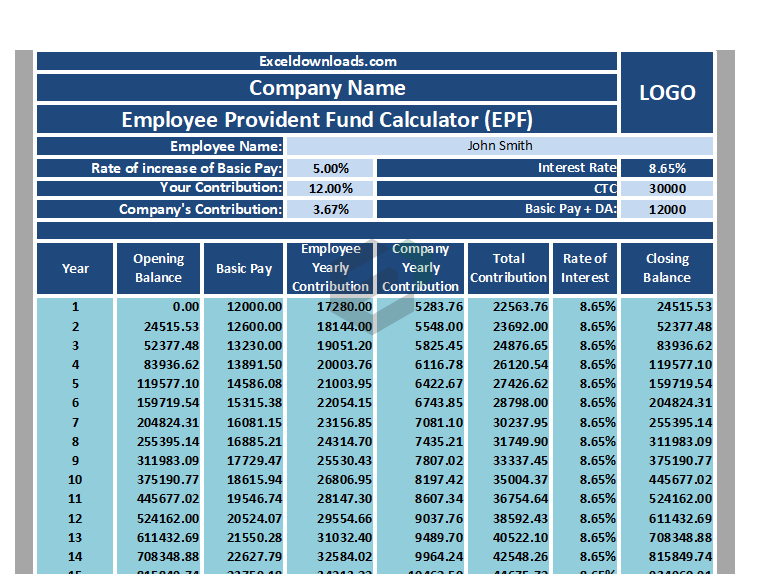

Download ready to use and easy to customize provident fund calculator relevant for Financial Year 2022, Financial Year 2023, Financial Year 2024 etc. This template is useful for employees, HR Personnel, business managers and other professionals to compute provident fund, contributions, interest and closing balances.

These calculations are based on EPF and MP (Employee Provident Fund and Miscellaneous Provisions) Act 1952 in India. For more details, you can visit the website EPFindia.gov.in.

About Employee Provident Fund Organization, India (EPFO)

EPFO is one of the World’s largest Social Security Organizations in terms of clientele and the volume of financial transactions undertaken. At present it maintains 24.77 crore accounts (Annual Report 2019-20) pertaining to its members.

The Employees’ Provident Fund came into existence with the promulgation of the Employees’ Provident Funds Ordinance on the 15th November, 1951. It was replaced by the Employees’ Provident Funds Act, 1952. The Employees’ Provident Funds Bill was introduced in the Parliament as Bill Number 15 of the year 1952 as a Bill to provide for the institution of provident funds for employees in factories and other establishments.

The Act is now referred as the Employees’ Provident Funds & Miscellaneous Provisions Act, 1952 which extends to the whole of India. The Act and Schemes framed there under are administered by a tri-partite Board known as the Central Board of Trustees, Employees’ Provident Fund, consisting of representatives of Government (Both Central and State), Employers, and Employees. (Learn more at their official website : EPFO, India)

What is Employee Provident Fund (EPF)?

Employee Provident Fund (EPF) is a retirement benefits scheme available for all salaried employees introduced by the EPFO under the supervision of the Government of India. EPFO is the Employees Provident Fund Organization of India.

EPF is a saving platform that helps employees to save a proportion of their salary every month. Employees can use it in the event either they are unemployed, unable to work, or at the time of retirement.

As an employee, we would like to know how much provident fund has been accumulated during the years of service.

The government has decided to retain the EPF interest rate of 8.% for the financial year 2021-22. This rate changes according to decisions made by EPFO.

Contribution Rate for Employee’s Salary up to Rs.15,000

- Employee contribution to EPF: 12% of salary.

- Employer contribution to EPF: 3.67% of salary.

- Employer contribution to EPS: 8.33% of salary subject to a ceiling of Rs. 15,000 salary, i.e. Rs. 1,250.

Breakup of Contribution if Salary is above Rs. 15,000

If an employee’s salary is Rs.15,000 or more, the employer’s 12% contribution is divided into two parts.

8.33% of Rs 15,000 goes to EPS account. i.e. Rs 1,250 per month, and balance

Amount exceeding Rs 1,250 per month is transferred to the EPF account.

For example, if an employee’s basic salary + dearness allowance is Rs.50,000:

- Employee contribution to EPF (12% of Rs.50,000): Rs. 6,000.

- Employer contribution to EPF (3.67% of Rs.50,000): Rs. 1,835.

- Employer contribution to EPS: Rs. 1,250.

Since 8.33% of Rs.50,000 is Rs. 4,165, Rs.1,250 is transferred to the EPS account, and the balance of Rs.2,915 is transferred to the EPF account.

The total balance in the EPF account is Rs. 10,750.

(i.e. employee contribution of Rs.6,000 + employer contribution of Rs.1,835 and excess contribution of employer towards EPS Rs .2,915.)

Eligibility for Employee Provident Fund (EPF)

Registering with EPFO is mandatory by the labor law for all organizations with more than 20 employees to register with the EPFO.

It is obligatory for the employees with a salary below Rs 15000 per month to register for EPF. Furthermore, employees having a salary above the prescribed limit can register for EPF with prior permission from the Assistant PF Commissioner and mutual acceptance between the employee and his employer.

Download and Use Employee provident fund calculator template in Excel

To use this free Employee provident fund calculator in excel, you should have Microsoft Office/ Microsoft Excel. You can only use this template if you have these applications in your system. or Use, Google Sheets.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template.