Download traditional Individual retirement account (IRA) calculator in Excel. Compute your traditional IRA output and withdrawals with the help of this template. Traditional IRA is an individual retirement account. Investing in traditional IRA helps you to grow your earnings tax-deferred.

Best Traditional IRA

In traditional IRA, you are entitle to the tax deduction in the contribution year for that particular year. You pay taxes on your investment gains only when you make sure to withdrawals during your retirement years.

This IRA Calculator helps to set your retirement goals and choose the amount to invest in IRA to achieve these retirement goals.

We have created an excel template for Traditional IRA Calculator with predefine formulas. You just need to input a few details and the calculations are automatic.

About Traditional IRA Calculator Excel Template

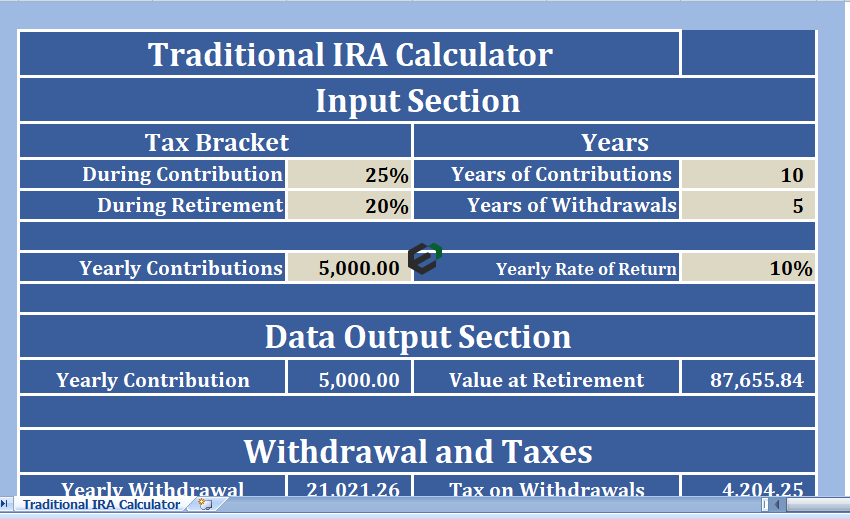

Once you download this traditional IRA Calculator Excel template, you will see 3 sections:

- Header Section

- Data Input Section

- Data Output Section

1. Header Section

As usual, the header section of the sheet ” Traditional IRA Calculator”. If you are a company, you can put your logo and company name on top of the sheet.

2. Data Input Section

The data input section consists of multiple details. In this section, you need to provide the following details:

Tax Bracket: Under this subheading, enter your current tax bracket and estimated tax bracket at the time of retirement.

Our sheet shows a very lower rate of tax bracket during retirement. Tax brackets are decided by federal authorities and thus it is always better to choose a feasible bracket. Because we don’t know what will happen during these ten years of the contribution.

Years: Also, Enter the number of years you wish to contribute along with the number of years of withdrawals.

Yearly Contributions: Yearly contributions means the amount you will invest on a yearly basis.

Yearly Rate of Return: As per the retirement goal you need to choose the investment plan. Different plans have a different yearly rate of return.

3. Data Output Section

Data output section consists of results entered values in respective cells.

Yearly Contributions: This amount is derived by linking the cell D9, It displays your amount of contribution.

Value At Retirement: It is total amount you will have at the time of retirement.

Yearly Withdrawal: After ten years, as you have opted for 5 years of withdrawal, you will get an amount every year for 5 years.

Tax on Withdrawals: As mentioned, you need to pay the then prevailing taxes on withdrawals in traditional IRAs. We have estimated an amount of 20%.

Take Home Amount: Take home yearly amount = Withdrawal – Tax % during retirement.

Difference between 401(k) and traditional IRA

To be simple and sweet –

- A 401K is a type of employer retirement account.

- An IRA is an individual retirement account.

While both plans provide income in retirement, each plan is administered under different rules.

How is 401(k) different from Roth IRA ?

| Feature | 401(k) | Roth IRA |

|---|---|---|

| Upfront tax break | Yes. Contributions are deductible. | No |

| Withdrawals | Taxed as ordinary income | Tax-free |

| Contribution Limits | In 2021, $19,500, or $26,000 if you’re 50 or over. In 2022, $20,500 or $27,000 if you’re 50 or over. | $6,000, or $7,000 if you’re age 50 or over |

| Income Limits | No | Yes. At higher incomes contributions are reduced or eliminated. |

| Employer Match | Yes. In 2021, there’s a $58,000 ($64,500 for 50 or over) limit on combined employer/employee contributions. The limits are $61,000 ($67,500 for 50 or over) in 2022. | No |

| Automatic Payroll Deduction | Yes | No |

| Earliest age to withdraw funds without penalty | 59½ | Withdraw contributions at any time, earnings at 59½ |

| RMDs | Yes. RMDs must start by April 1 following the later of the year you reach age 72 or the year you retire. | Not during the owner’s lifetime |

| Average Fees | High | Low |

| Investment choices | Few | Many |

| Maintained By | Employer | Self |

Download and use traditional IRA Calculator Excel Template

Now, let us look into how to use this traditional IRA Calculator excel template. You should have Microsoft Office/ Microsoft Excel installed in your system.

Post installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.