Download GST Delivery Challan Format in Excel and Spreadsheet for businesses. In general business procedures, The consignor issues a GST Delivery Challan in lieu of GST Tax Invoice at the time of goods are removed for transportation for the purpose of job work, the supply of goods from primary office to branch etc.

Understanding Delivery Challan

According to the rules provided by the government, rules for issuance of the delivery challan are as below:

- For the purposes of

-

-

- supply of liquid gas where the quantity at time of removal from place of business of the supplier is not known,

- transportation of goods for job work,

- transportation of goods other than by way of supply, or

- such other supplies as notified by the Board,

-

-

- The consignor may issue delivery challan, serial number not exceeding sixteen characters, in one or multiple series, in lieu of invoice at the time of removal of goods for transportation.

- The delivery challan shall be prepared in triplicate, in the case of supply of goods.

- Where goods are transported on a delivery challan in lieu of invoice, the same shall be declared in FORM [WAYBILL].

- Where goods being transport are for the purpose of supply to the recipient.

- Where goods are transport in a semi-knocked down or completely knock down condition.

About Delivery Challan under Goods and Service Tax (GST)

In accordance with above-mentioned guidelines, this GST Delivery Challan in Excel Format is useful for your business. You need to enter your company name, address, logo and start issuing the Delivery Challan.

With this free excel GST template, you can issue delivery challan in triplicate copy for the purpose of transportation of goods for job work, the supply to other branches from your preliminary office etc.

However as per the rules, the triplicate copies of Delivery challan is useful in following ways –

- the first copy is for the consignee,

- second for the Transporter and

- the third for the consignor.

Consequently, If the supply is full and final, it is better to issue GST tax invoice. It is useful for textile, chemical and other similar industries where deliveries take place in installments.

Understanding GST Delivery Challan Format in excel

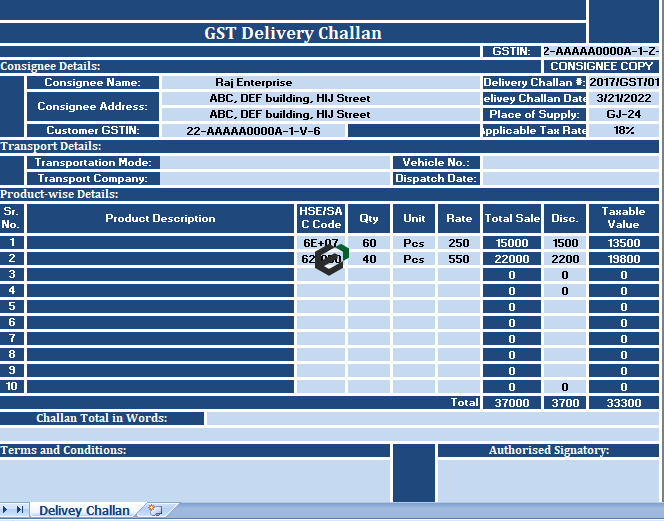

Once you download this free GST Excel template for Delivery challan, you will find five sections, namely,

- Header Section.

- Consignee Details Section.

- Product Details Section.

- Signature and Remarks Section.

1. Header Section

On the top, the Header section consists details like the company name, company address, company logo, GSTIN and the document heading “GST Delivery Challan”.

2. Consignee Details Section

So, The receiver of goods is called the consignee in terms of transport. This section consists the details of the consignee such as name of the consignee, consignee address, GSTIN, Delivery Challan Number, Place of Supply (POS) and the date of issue.

3. Transport Detail Section

Unlike other documents under GST, this section also contains transport details such as transportation mode (air/sea/land), the name of the transport company, vehicle number or flight number and date of dispatch.

4. Product Details Section

However, Products details contains the following columns:

- Sr. No.: Serial number.

- Product Description: Description of Product such as size, color, dimensions etc.

- Qty: Quantity of goods.

- Units: Units of product. It can be pieces, bags, meters etc.

- Rate: Rate of product.

- The Total Sale: Total Sale = Quantity X Rate.

- Disc.: Discounts if any.

- Taxable Value: Taxable value column is auto calculate. The Total Sale – Discount = Taxable Value.

- Totals: The total of each column for summary.

A delivery challan doesn’t have tax columns. A tax invoice has to mandatorily issue after delivery of goods.

5. Signature Section

Now, the signature section consists of Challan total in words, the signature box for authorize signatory, remarks, and business greetings.

Download and use GST Delivery Challan format in Excel

To use this free GST INDIA DELIVERY CHALLAN excel template, you should have Microsoft Office/ Microsoft Excel installed in your system. After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template. You can customize the currency, color scheme, fields in this excel template as per your requirement.