Download this simple tax estimator – free to download and ready to use Microsoft Excel and Spreadsheet template. This template will help you compute your federal income tax.

Hence, this template consists of computations of adjustments, Tax credit, itemized deductions etc.

About Simple Tax Estimator excel template

Here, a user needs to input in respective cells and it will automatically estimate your tax liability. It is better for a taxpayer to prepare priory for tax returns in advance. So, Filing near the deadline might cost you with more money.

Moreover, You may miss some necessary deductions, tax credits, and other items which might increase your taxable income. Thereby, increasing your tax amount.

So, This simple tax estimator in excel with pre-set formulae helps a lot in such cases. Simply, enter the amounts in white cells only. Blue colored cells contain formulas and references for calculations.

Contents of Simple Tax Estimator

Post downloading this template. You can find that it consists of two sections. Let us understand the use of these sections individually.

- Taxability Details

- Assumptions

1. Taxability Details

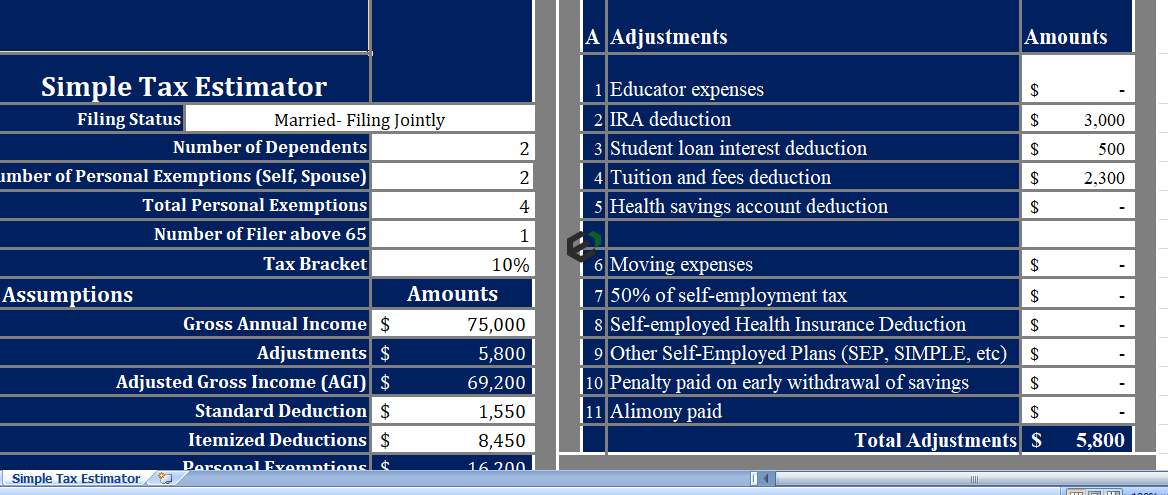

This is basic tax information and details consist of following:

- Filing Status.

- Number of Dependents.

- Number of Personal Exemption.

- Total Personal Exemptions.

- Number of Filer Above 65 years of Age.

- Tax Bracket.

Similarly, Select your filing status from drop-down list. Single, Married filing jointly, married filing separately or Head of Household.

2. Assumptions

Assumptions consist of the following:

- Gross Annual Income

- Adjustments

- AGI – Adjusted Gross Income

- Standard Deductions

- Itemized Deductions

- Personal Exemptions

- Total Taxable Income

- The Tax Credits

- Tax Estimate.

So, Gross annual income is the total of income from all sources.

Adjustments

To calculate your adjustments use the table given beside the Simple Tax Estimator. Just enter the amounts applicable for you.

Similarly, It will automatically reflect in the template as it refer to the respective cell.

Adjustments include following details:

- Educator expenses.

- IRA deduction.

- Student loan and interest deduction.

- Tuition and fees deduction.

- Health savings account deduction.

- Moving expenses.

- 50% of self-employment tax.

- Self-employed Health Insurance Deduction.

- Other Self-Employed Plans (SEP, SIMPLE).

- Penalties paid for early withdrawal of savings.

- Alimony paid.

Adjusted Gross Income

Adjusted Gross Income [AGI] = Gross Income – Adjustments

If your itemized deductions are higher then only go for it. Otherwise, a standard deduction is always a better option. As mentioned earlier, if the filer is above the age of 65 years, then they can additionally take $ 1,550 as a Standard Deduction. Thus, It will automatically calculate the amount as per number of dependents.

Formula for Total Taxation income

So, to compute total Taxable Income

Taxable Income = AGI – Standard Deductions – Itemized Deductions – Personal Exemptions.

Tax Credits

At the end, there are tax credits. If you are entitled to tax credits then you will calculate your tax credit in the section below adjustments.

Moreover, You need to enter your applicable tax credit. It will automatically reflect in the sheet through cell reference Lastly, there is the tax estimate.

Tax Estimate = Taxable income X Tax Bracket – Tax Credits.

Download and use Simple Tax Estimator Excel Template

Now, let us look into how to use this Simple tax estimator excel template. You should have Microsoft Office/ Microsoft Excel installed in your system.

Post installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template. You can change currency and fields but with caution.