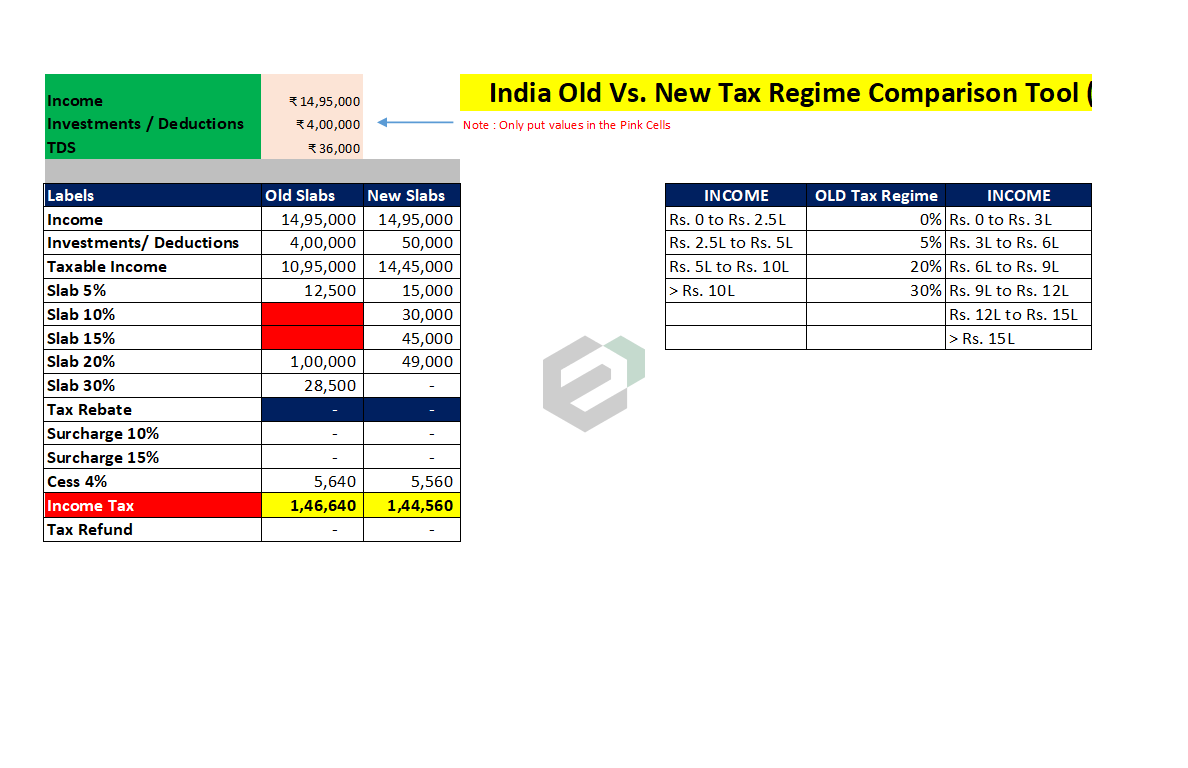

Download free excel template for comparing total tax payable in India under Old Tax Regime and New Tax Regime for Financial Year 2023-2024. This template is useful for individuals and professionals for tax planning and selection of tax regime.

This is a template for Old Tax Regime Vs. New Tax Regime Updated Calculator for Financial Year 2023-24 i.e. Assessment Year 2024-25 after considering new tax slabs proposed by Union Budget 2023.

Understanding Key Changes in the Tax Regime

For the AY 2024-25, the basic exemption limit for New Tax Regime has been increased to Rs. 3 lakhs and number of tax slabs has bene reduced to five as under:

| Taxable Income | Tax Rate |

|---|---|

| Up to Rs. 3 lakhs | Nil |

| Income more than Rs. 3 lakhs up to 6 lakh | 5% |

| Income more than Rs. 6 lakhs up to 9 lakh | 10% |

| Income more than 9 lakhs upto 12 lakhs | 15% |

| Income more than 12 lakhs up to 15 lakhs | 20% |

| Income above Rs. 15 Lakh | 30% |

The Finance Bill 2020 (26 of 2020) has inserted new sections namely section 115BAC to introduce the new Scheme of Taxation on income of Individuals and HUFs.

The Budget 2023-24 proposes to make the New Tax Regime u/s 115BAC as the default one. However the taxpayers shall have an optional to choose old regime.

Unlike the existing tax regime consisting of three taxable slabs with minimum tax rate of 5% and highest being 30%, the New Tax Regime consists of five taxable brackets with minimum tax rate of 5% with 5% incremental rise for each higher tax brackets except for fifth slab where incremental rise is 10%..

A comparative chart of the tax brackets and rates under both Regime is as under:

| Tax Brackets | Tax rate (Existing Regime) | Tax Rate (New Regime) |

|---|---|---|

| Upto Rs 2.50 Lakhs | Nil | Nil |

| From > Rs. 2.50 lakhs to Rs. 3.00 lakhs | Nil | 5% |

| From > Rs 3 Lakhs to Rs 5 Lakhs | 5% | 5% |

| From > Rs. 5 lakhs to Rs. 6 lakhs | 5% | 20% |

| From >Rs. 6 lakhs to Rs. 9 Lakhs | 10% | 20% |

| From > Rs 9 lakhs to Rs 10 lakhs | 15% | 20% |

| From > Rs. 10 lakh to Rs. 12 Lakhs | 15% | 30% |

| From Rs 12 Lakhs to Rs 15 Lakh | 20% | 30% |

| Above Rs 15 Lakhs | 30% | 30% |

Going by the above table alone, its seems a perfect gift to the taxpayers where tax rates have been slashed and more tax brackets have been provided to reduce the tax burden. But this lucrative New Tax Regime comes with a condition that many taxpayers would not appreciate.

Under the New Tax Regime, the assesse shall not be entitled to most of the exemptions and deductions that a common taxpayers has relied upon extensively not only to make investments but also to plan and reduce his tax. The notable deductions/exemptions that would be unavailable in the new Tax Regime include standard deduction on salaries, housing loan interest, section 80C deductions (for insurance premium, P.F., tuition fees, etc.) etc.

The relief however is that the new Regime is only optional and is totally at the wisdom of the assesse whether to choose it or not.

Taxpayers are in a fix what to do. Whether to continue existing payments towards insurance premium, provident fund etc. or whether defer their housing loan etc. The helpless individual taxpayers which do not have access to a tax expert are finding hard to determine which tax regime is beneficial to them.

How to use this template ?

Below is the basic instruction on how to use this comparison tool/ excel template –

- Download the Income Tax Calculator FY 2023-24 Excel on your device

- Provide Income as Gross Income for FY 2023-24

- Provide Investments including Standard Deduction, Section 80C investments, Section 80CCD(1B) investments and other tax saving options you are eligible for. Total amount of investments need to be entered. Standard Deduction of Rs. 50,000 is applicable for Employees.

- Enter TDS amount that is already deducted from your salary in financial year

- After providing all these parameters, income tax will be calculated based on Old and New Tax Regime

Download and use India Old Tax Regime Vs. New Tax Regime Comparison Excel template for FY 23-24

To use this free comparison excel template, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template. Extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template.