Download this free to download and easy to use Roth IRA Calculator Excel format. This template comes with pre-set formulae and fields. You can simply put in – contribution years, contribution amount and few other details. It will automatically calculate the results for your. Download now.

If you are looking for traditional IRA Calculator in Excel. Check out our template for that as well.

Understanding Roth IRA – History

A Roth IRA is yet another type of individual retirement account. Investing in Roth IRA is different from Traditional IRA.

A Roth IRA is a type of Individual Retirement Arrangement (IRA) that provides tax-free growth and tax-free income in retirement. The major difference between Roth IRAs and traditional IRAs is that contributions to the former are not tax-deductible, and contributions (not earnings) may be withdrawn tax-free at any time without penalty.

Roth IRA was first introduced and established by the Taxpayer Relief Act of 1997 and is named after Senator William Roth.

Roth IRA accounts can be opened at many different institutions, from the largest, most well-known financial companies, to online-only investment companies and financial service firms. The IRS regulates all of these institutions, and all of them must meet certain requirements, but each can still have its own differentiating perks.

About Roth IRA Calculator Excel Template

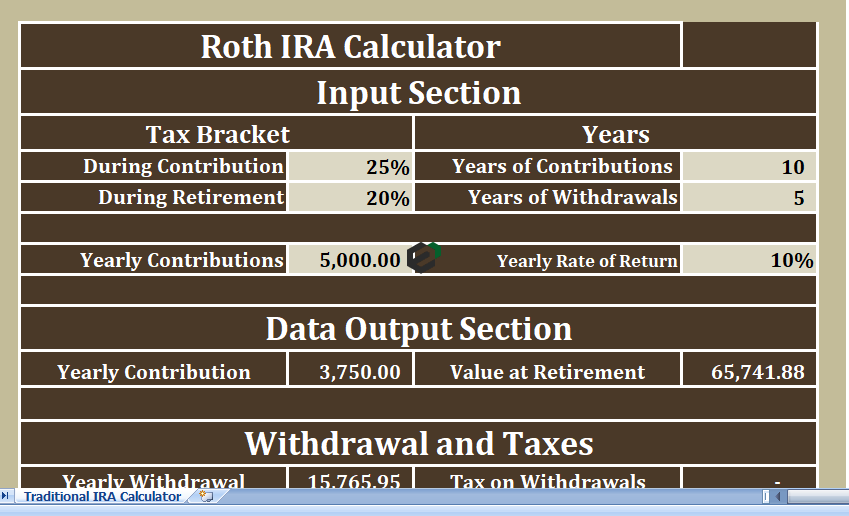

Similar to Traditional IRA Calculator, this calculator also consists of 3 sections:

- Header Section

- Input Section

- Output Section

The difference is only in contribution amount. As your contribution amount is taxed, the actual amount contributed is less for Roth IRA.

1. Header Section

The header section of the heading sheet ” Roth IRA Calculator”.

If you are an advisory company, you can use this by putting your logo and company name on top.

2. Input Section

All the headings in the section are same as Traditional IRA. In other words, you need to provide same details as in the case of Traditional IRA.

- Tax Bracket: Moreover, Under this heading, there are two subheads. First is your current tax bracket and second is tax bracket at the time of retirement.

- Years: However, Here you have to enter the number of years you are planning to contribute and the number of years you want for withdrawals.

- Yearly Contributions: Subsequently Yearly contributions means the amount you will invest in yearly basis.

- Yearly Rate of Return: As per your retirement goal you need to choose investment plan. Different plans have a different yearly rate of return.

3. Output Section

Output section will display the results in respective cells according to amounts, years and rate of return enter in the input section.

- Yearly Contributions: As the contributions aren’t tax-free in Roth IRA, tax applicable during the contribution will deduct from this amount.

- Value At Retirement: It is total amount you will have the time of retirement.

How is 401(k) different from Roth IRA ?

| Feature | 401(k) | Roth IRA |

|---|---|---|

| Upfront tax break | Yes. Contributions are deductible. | No |

| Withdrawals | Taxed as ordinary income | Tax-free |

| Contribution Limits | In 2021, $19,500, or $26,000 if you’re 50 or over. In 2022, $20,500 or $27,000 if you’re 50 or over. | $6,000, or $7,000 if you’re age 50 or over |

| Income Limits | No | Yes. At higher incomes contributions are reduced or eliminated. |

| Employer Match | Yes. In 2021, there’s a $58,000 ($64,500 for 50 or over) limit on combined employer/employee contributions. The limits are $61,000 ($67,500 for 50 or over) in 2022. | No |

| Automatic Payroll Deduction | Yes | No |

| Earliest age to withdraw funds without penalty | 59½ | Withdraw contributions at any time, earnings at 59½ |

| RMDs | Yes. RMDs must start by April 1 following the later of the year you reach age 72 or the year you retire. | Not during the owner’s lifetime |

| Average Fees | High | Low |

| Investment choices | Few | Many |

| Maintained By | Employer | Self |

Download and use Roth IRA Calculator Excel Template

Now, let us look into how to use this Roth IRA Calculator excel template. You should have Microsoft Office/ Microsoft Excel installed in your system.

Post installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.