Download free excel template for weekly payroll computation. This template is useful for payroll managers, consultants and HR Personnel.

About Weekly payroll sheet

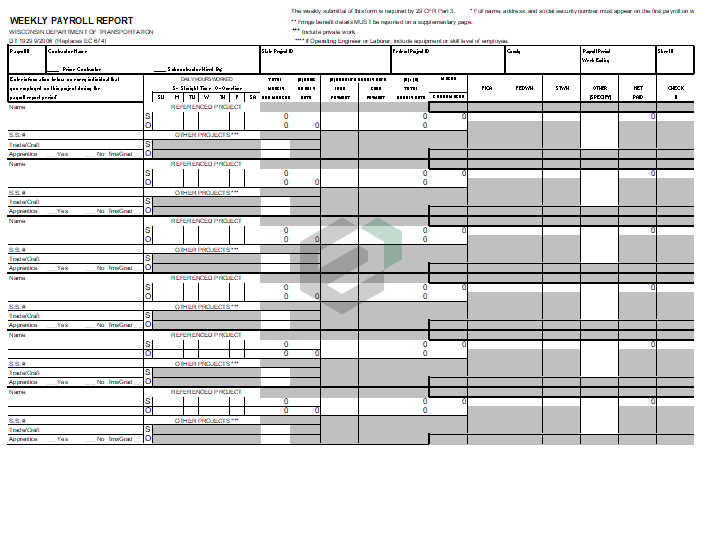

A weekly payroll sheet is a document that outlines the wages and salaries earned by employees in a given week. It typically includes the following information:

- Employee name: This is the name of the employee whose wages are being recorded.

- Employee ID: This is a unique identifier for the employee, such as a social security number or employee number.

- Hours worked: This is the number of hours the employee worked during the pay period.

- Hourly rate: This is the employee’s hourly wage rate.

- Overtime hours: If the employee worked more than their standard number of hours in a given week, this column will show the number of overtime hours worked.

- Overtime rate: This is the employee’s overtime wage rate, which is typically 1.5 times their regular hourly wage rate.

- Gross pay: This is the total amount of money the employee earned before taxes and other deductions are taken out.

- Taxes: This is the amount of money that is withheld from the employee’s pay for federal, state, and local taxes.

- Insurance: This is the amount of money that is withheld from the employee’s pay for insurance premiums, such as health insurance or life insurance.

- Retirement: This is the amount of money that is withheld from the employee’s pay for retirement savings, such as a 401(k) or pension plan.

- Net pay: This is the employee’s final pay after all deductions have been taken out. It is the amount of money that the employee will receive in their paycheck.

Download and use this template

To use this free excel template, you should have Microsoft Office/ Microsoft Excel installed in your system. After installing Excel or Spreadsheet, download the zip file of this template.

Now, extract the template using WinZip, WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.