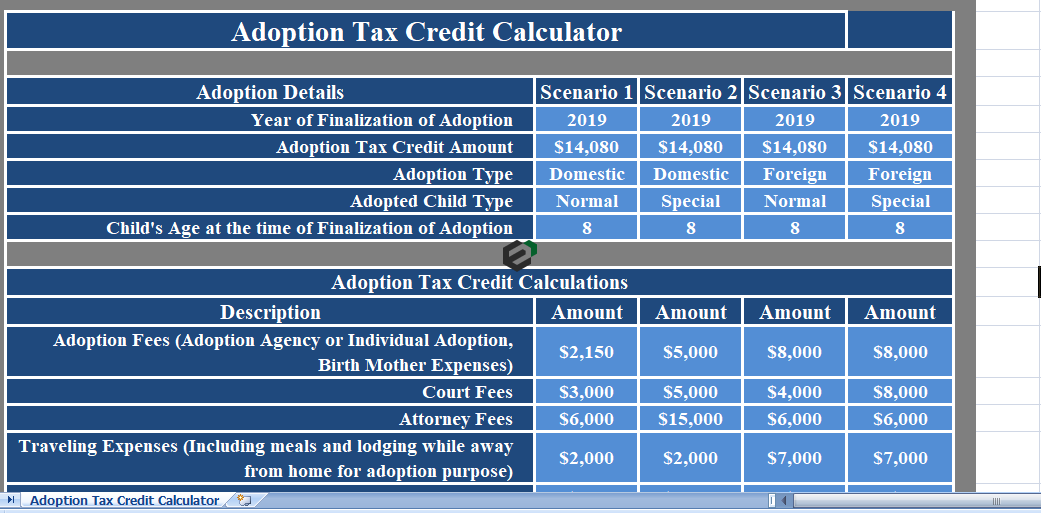

Download Adoption Tax Credit Calculator in Microsoft Excel and Spreadsheet. This is easy to download and use excel template which helps you to calculate the Adoption Tax Credit for different scenarios, namely,

- Domestic Normal and Special Needs Child

- Foreign Normal and Special Needs Child

All you have to do is enter the adoption credit limit and the applicable year. This is printable adoption tax credit calculator for any year.

Adoption tax credit 2021

Adoption Tax Credit is a provision that provides the taxpayer the opportunity to deduct expenses spent in the adoption process. A taxpayer can be a qualify expenses approved by the IRS. This credit is available to international, domestic private, and public foster care adoption. Taxpayers who adopt their spouse’s child can’t claim this credit.

About Adoption Tax Credit Excel Calculator

This template is simple and easy Adoption Tax Credit Calculator Excel template with predefine formulas and formatting. Enter your actual expenses for the adoption process. It will automatically calculate claimable adoption credit for you.

Adoption details consist of the following :

Year of Finalization of Adoption

The claim depends on type of adoption. For domestic adoption, the expenses paid before and during particular year can be claimed in the following year of payment.

You can even claim if the adoption has not finalized or even an eligible child is not identified.

In case of foreign adoption, expenses paid before and during the year can only be claim in the year when the adoption becomes final.

Adoption Credit

IRS changes adoption credit limit every year. The credit limit for year 2019 is $ 14,080. For 2021, the limit for adoption credit is $14,440.

Insert the amount that is applicable for the particular year you plan to take this credit.

Example, Suppose in Year 2019, Parents adoption is a normal eligible child, you can claim actually spent expenses up to $ 14,080. Parents adopting eligible special needs are eligible for the maximum amount of $ 14,080 credit in the year of finalization.

Adoption Type

Firstly, Select the type of adoption. It can be either domestic or foreign.

Rules are different for both types of adoption.

Adopted Child Type

Similar to the above, rules for availing the credit are different as per adopt child.

Child’s Age at the time of finalization

However, Insert the age of the child at the time of the finalization of the adoption. A child is only eligible for adoption credit if is under the age of 18 who is a U.S. citizen or resident (including U.S. territories) or a non-US citizen.

Understanding the adoption credit limit for FY 21

Here is some basic information to help people understand this credit and if they can claim it when filing their taxes:

- The maximum adoption credit taxpayers can claim on their 2021 tax return is $14,440 per eligible child.

- There are income limits that could affect the amount of the credit

- Taxpayers should complete Form 8839, Qualified Adoption Expenses. They use this form to figure how much credit they can claim on their tax return.

- An eligible child must be younger than 18. If the adopted person is older, they must be unable to physically take care of themselves.

- This credit is non-refundable. This means the amount of the credit is limited to the taxpayer’s taxes due for 2021. Any credit leftover from their owed 2021 taxes can be carried forward for up to five years.

- Qualified expenses include:

-

-

- Reasonable and necessary adoption fees.

- Court costs and legal fees.

- Adoption related travel expenses like meals and lodging.

- Other expenses directly related to the legal adoption of an eligible child.

-

-

- In some cases, a registered domestic partner may pay the adoption expenses. If they live in a state that allows a same-sex second parent or co-parent to adopt their partner’s child, these may also be considered qualified expenses.

- Expenses may also qualify even if the taxpayer pays them before an eligible child is identified. For example, some future adoptive parents pay for a home study at the beginning of the adoption process. These parents can claim the fees as qualified adoption expenses.

Source : IRS

Download and use adoption tax credit calculator excel template

Now, let us look into how to use this Adoption tax credit calculator template. You should have Microsoft Office/ Microsoft Excel installed in your system.

Post installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template. You can change currency and fields but with caution.