Download Adjusted Gross Income Calculator in Microsoft Excel and Spreadsheet for Federal Income Tax computation. This AGI or Adjusted Gross Income Calculator helps you calculate your tax bracket as well as tax liability.

What is Adjusted Gross Income?

Adjusted Gross Income (AGI) is the basis of various tax thresholds. It eventually helps to determine eligibility for certain tax credits.

Adjusted Gross income (AGI) is your total income less allowable deductions.

About Adjusted Gross Income Calculator Excel Template

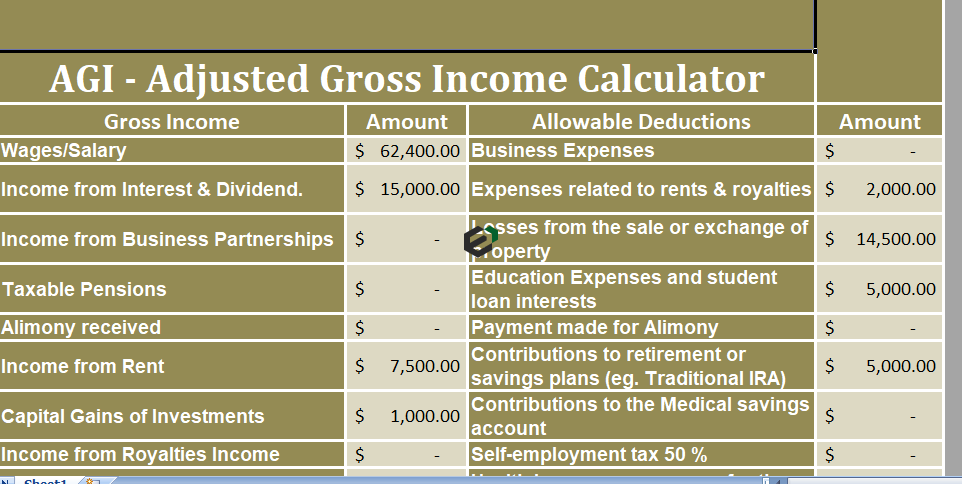

Once you download this Federal Income tax – AGI Calculator template, You will see four different sections, namely,

- Firstly The Header Section

- Secondly The Gross Income Section.

- Thirdly Allowable Deductions Section.

- Subsequently Calculation of AGI

1. Header Section

However, The header section contains the basic information around AGI Calculator. Also, If you are an advisory or consulting company you can add company name or logo in the template.

2. Gross Income Section

This section consists of income from different sources. These sources include:

- Wages / Salary.

- Income from Dividends.

- Income from Business.

- Taxable Pension.

- Alimony Received.

- Rental Income.

- Capital Gains on Investment.

- Royalty Income.

- Income from Farming activities.

- Unemployed Compensations.

Enter amounts of all applicable incomes in all respective cell. At the end, this will evaluate your Total Gross Income.

3. Allowable Deductions

These claimable deductions allowed by IRS are:

- Expenses for Business Purposes.

- Expenses related with rent or royalties.

- Losses made during sale/ exchange of properties.

- Student Loan Interests.

- Alimony paid.

- Contributions towards IRAs.

- Contributions to the Medical Saving Accounts.

- 50% of Self employment tax.

- Self-employed Health Insurance Expenses.

Therefore, Enter amounts of all applicable incomes in their respective cell. So, it will evaluate your Total Gross Income.

4. Calculation of AGI

So, Now it is time to compute the adjusted gross income (AGI). The Calculation of AGI is 3 step process.

- Adding income from all sources.

- Adding applicable allowable expenses.

- The difference of Gross Incomes less of Allowable Deductions.

Therefore the Formula is:

So, AGI = Gross Income – Allowable Deductions

Where to find Adjusted Gross Income in tax return ?

Subsequently, Gross Income is the total of your income from all different sources. However, Gross Income doesn’t include gifts, inheritances, tax-free Social Security benefits or tax-free interest from state or local bonds. Moreover, Allowable deductions are the one claimable expenses allowed by IRS. Furthermore, The allowable deductions use to derive AGI deduction prior to tax exemptions for military service, dependent status, etc.

Download and use Adjusted Gross Income Calculator excel template

Now, let us look into how to use this Adjusted Gross Income calculator excel template. You should have Microsoft Office/ Microsoft Excel installed in your system.

Post installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template. You can change currency and fields but with caution.