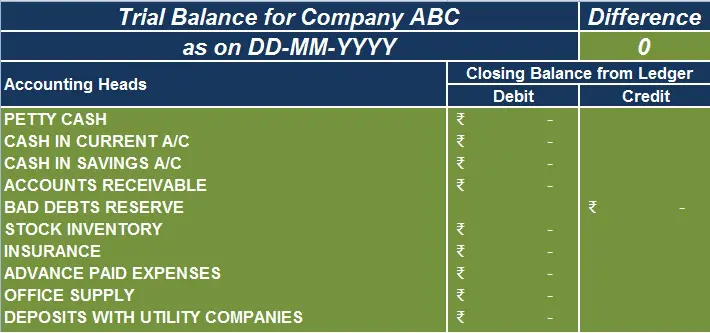

Trial Balance Template is a free and easy to use template in Excel. It helps you to make the statement of all closing balances of ledger accounts on a certain date. Every company or organization must prepare Trial Balance before starting to prepare the financial statements.

Trial balance is, somehow, similar to soft audit of all the accounting balances. Thus, the preparation of trial balance is crucial part for business accounting.

Understanding Trial Balance

Trial Balance is a document which records the closing balances of all the ledger accounts at the end of the accounting period. It is a statement with all closing balances of ledger accounts on a certain date.

Usually, it is prepared at the end of an accounting period that assists us in the easy drafting of other financial statements.

Thus, preparing this document is the first and foremost step in the preparation of financial statements.

Types of Trial Balance

There are 3 types of Trial Balance Statement prepared by businesses and professionals –

- Unadjusted Trial Balance

- Adjusted Trial Balance

- Post-Closing Trial Balance

Unadjusted Trial Balance

Unadjusted Trial Balance is the first and foremost document to be prepared for final accounts. You need to prepare it before passing any adjustment entries. In other words, it is prepared to find the unadjusted ledger balances if there are any in our ledgers.

Adjusted Trial Balance

Adjusted Trial Balance is prepared to see whether the adjustment entries passed are correct or not after making all adjustments.

Post-Closing Trial Balance

Usually, the Post-Closing Trial Balance will be the same as above. Sometimes due to adjustments or unrecorded entries, the balances of ledgers might change. It helps add the opening balances for the next accounting year.

Rules for preparation of Trial Balance

Now, Let us look into some of the rules that one should be careful about, while preparing a trial balance for their or client’s business –

- You must record all the assets on the debit side.

- Similarly, you must record all the liabilities on the credit side.

- Record Income/gain on the credit side.

- Record all expenses on the debit side.

How to prepare Trial Balance ?

To prepare Trial balance for your personal finance, business or client, follow the steps given below –

- To prepare this document, all the ledger balances are separated into debit and credit balances.

- On the debit side, you record the Assets and expenses accounts. Whereas, on the credit side you record the liabilities, capital, and income accounts.

- The main purpose of preparing this document is to ensure that all the entries are made according to the ruling of the double-entry system.

- Totals of both debit and credit side should match. If the totals don’t match, we need to investigate the differences. It is mandatory to resolve before the preparation of financial statements.

- It is mandatory to resolve before the preparation of financial statements.

Download and use Trial Balance free Excel template

To use this free Trial Balance free excel template, you should have Microsoft Office/ Microsoft Excel installed in your system. Also, This trial balance format can be useful for personal and professional use.

Next Step, After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.