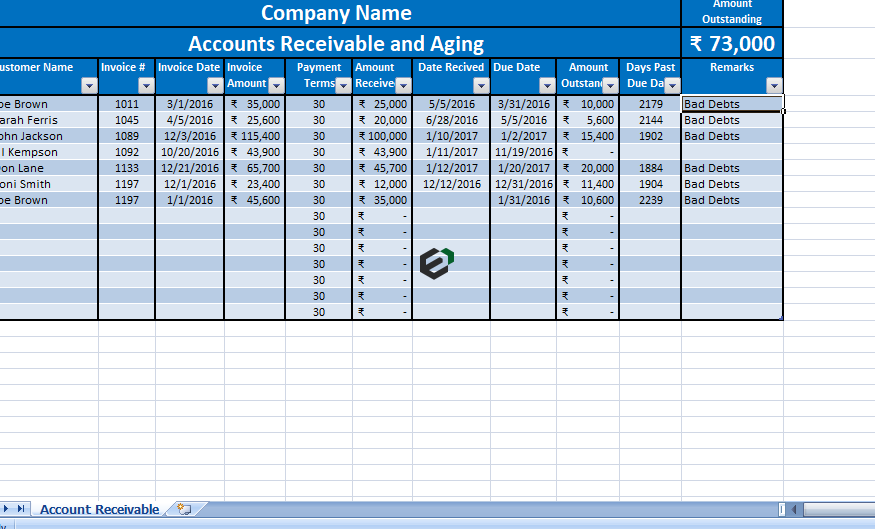

Download accounts receivable report template with ageing in Excel and Spreadsheet. This report is also known as “Debtors Ageing report“. This free excel template records the sale of services or goods by a company on credit. Alternately, Account receivable Ledger records the credit invoices of a company to its debtors. Moreover, you may also generate debtors-wise, date wise, period wise aging reports.

Understanding Accounts Receivable

Accounts receivable means enforceable claim for payment that a business holds for supply of goods or services to customers and not paid for. These are generally in the form of invoices that a business raises and delivers it to the customer for payment within an agreed time frame.

These Accounts Receivables are our assets and listed as a current asset on our balance sheet. Accounts receivable can be further subdivided into two categories, namely;

- Trade receivables – receivables from company’s routine sales activities

- Non-trade receivables – all other receivables that are non-routine, example – employees due against loan.

What is Accounts Receivable Ageing Report ?

The total amount of accounts receivable which a company allows to debtor/customer is often limit by a credit limit. This limit is set usually by the company’s credit department. The payments delayed over this credit limit is called ageing. Ageing reports are crucial to manage cashflow and forecast for a company.

You can increase or decrease the credit limit period according to the market conditions and negotiation with the customers.

Importance of Accounts Receivable Ageing Report

The higher the accounts receivable higher our assets will be. But, Just making good sales is not enough.

Collections should also be done timely and thus help decrease our bad debts. So, it must keep in mind that we must have a minimum amount of bad debts. Moreover, it helps to monitor our billing and collection process. This includes regular and strict follow-ups with the clients for payments.

The ageing report also helps us to define and manage the credit policies. This includes client-wise evaluation of payment terms and making necessary changes as required.

The collection of Accounts Receivable defines the cash flow of any company. Delays in accounts receivable collections may lead to lower cash flows. Monitoring of aging reports at regular intervals can help us to decrease the chances of Bad Debts.

Furthermore, a company can use accounts receivable as collateral for loans from banks or other non-banking finance corporations.

Moreover, it is also helpful in defining the Allowances for Doubtful Debts at the time of preparing financial year statements.

Journal Entries for Bad Debts

Given below are the different Journal entries for reporting Bad Debts.

Journal Entry for Bad Debts

- Bad Debts A/C – Debit

- Debtor’s A/C – Credit

Journal Entries for Bad Debts Recovery

- Debtor’s A/C – Debit

- Bad Debts Recovery A/C – Credit

Closing Journal Entry for bad debts

- Profit and Loss A/C – Debit

- Bad Debts A/C – Credit

Download and Use Accounts receivable report with ageing Excel template

To use this free accounts receivable report with ageing excel template, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template.