Download free excel templates as per United Kingdom (UK) VAT Act for issuing a VAT compliance invoice to your clients for taxable goods and services with auto calculations. This template is helpful to small and medium scale business people to issue VAT compliance invoices to their clients.

This template covers all legal compliances and legal provisions as per UK VAT Act. It is customizable as per the requirement. This template is useful to small and medium-sized businesses that don’t use any software for record-keeping.

About UK VAT Act

VAT Law in the United Kingdom (UK) is governed mainly by the Value Added Tax Act 1994 as amended by subsequent Finance Acts. But, there are many rules in Statutory Instruments. These are either orders made by the Treasury or regulations made by HMRC.

The Value-Added Tax Act provides for the taxation of the supply of goods and services and the importation of goods. This Act is applicable to all registered VAT vendors.

VAT was introduced as consumption tax and later on termed as Value Added Tax. Currently, there are 3 different VAT rates in UK – 20%, 5%, and 0%.

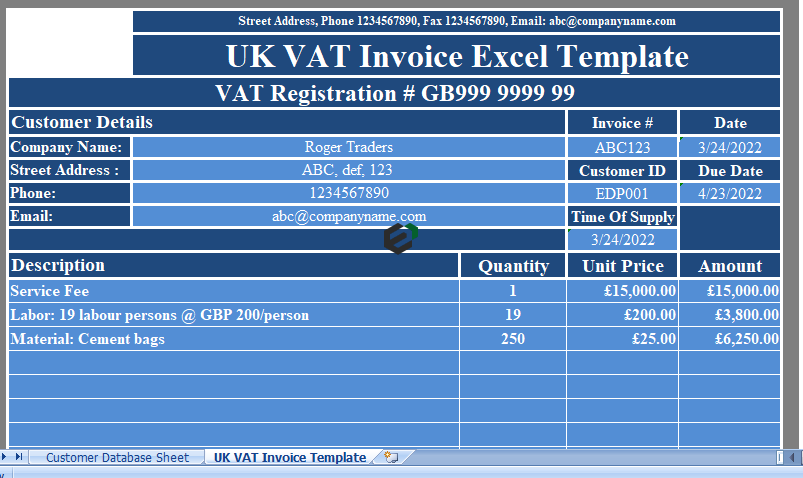

UK VAT Invoice Excel Template

We have created a UK VAT Invoice excel template with predefine formulas and formatting. You can easily issue invoice to your customers with help of this template. This template has 2 worksheets;

- UK VAT Invoice Template and

- Customer Database sheet.

1. Customer Database Sheet

The database sheet contains list of your customers. These customers are those we issue the invoices for goods supplied or services rendered regularly.

2. UK VAT Invoice Template

The UK VAT Invoice contains the Proforma of invoice as per guidelines. It consists of 4 sections. The four sections are briefly discussed below –

a. Header Section

The header section consists of company’s logo, name, VAT Registration Number and the heading of the invoice.

b. Customer Details

The customer details section consists of client’s details as below:

- Company Name

- Street Address

- Phone

- Invoice

- Date

- Customer ID

- Due Date

- Time Of Supply

This section is connect with data validation and VLOOKUP function to the database sheet. Thus, when you select the name of the customer it will automatically update the Address, phone, email, and customer id.

In addition to this, on the right-hand side, you need to enter invoice number, invoice date, due date of payment and time of supply or tax point. In case of credit invoice, the due date is set as 30 days from the date of the invoice. If your invoice is cash then leave this space blank.

c. Product Details

The product details section consists of following columns:

- Description: Insert description of goods or services to your client.

- Quantity: Quantity of product.

- Unit Price: Price per product.

- Amount: This column shows the total amount of supply per item using Quantity multiply by Unit Price. The final total of this column is the taxable amount.

d. Other Details

Other details section consists of following:

- Amount in words: No need to insert anything in this. It will automatically convert the amount in words using Spell Number GBP.

- Terms & Conditions: Insert your invoice terms and conditions.

- VAT computation: Select type of VAT from the dropdown list.

Taxable Amount X VAT % = VAT Amount

- VAT Amount + Taxable Amount = Final Invoice Amount

- Company seal: A blank space is given for company seal. After printing invoice you can stamp here.

- Signature: A blank space is given for authorized signatory. After printing the invoice the authorized personnel can sign the invoice here.

- Thank You Note: Insert a thank you note of your choice here.

Finally, your UK VAT Invoice is ready to print.

Download and Use UK VAT Invoice Format in Excel

To use this free UK VAT Invoice Format in excel, you should have Microsoft Office/ Microsoft Excel. You can only use this template if you have these applications in your system. or Use, Google Sheets.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.