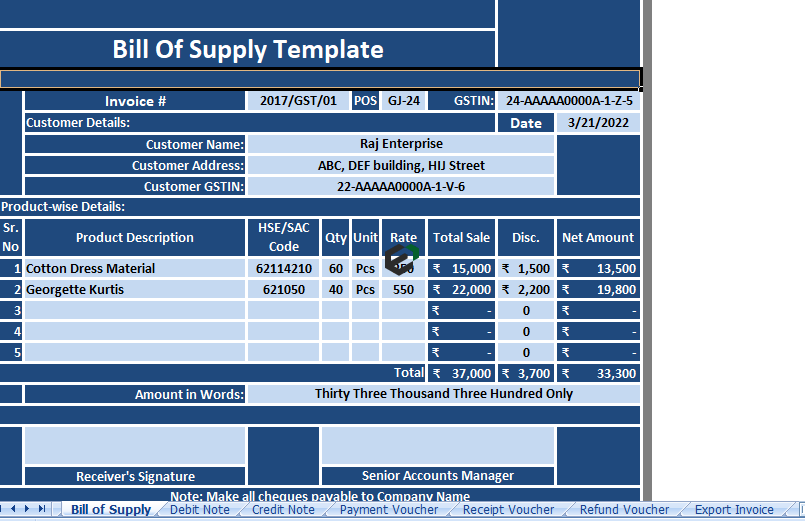

Download this GST Bill of Supply format in Excel and Spreadsheet for businesses. Use this free GST Excel template to issue bill of supplies in your business wherein you do not have tax information. Scroll down to understand more and download excel format for Bill of supply under Goods and Service Tax (GST).

The GST Bill format for composition scheme holders and supply of non-taxable goods or services is the “Bill of Supply“.

Bill of Supply under Goods and Service Tax (GST)

A Bill of Supply is a document issued by GST Registered Businesses in place of a Tax Invoice. It is used by Composition Vendors and businesses dealing with Exempted Goods.

Tax Invoice is issued in case a registered person is supplying taxable goods or services or both and also charge GST from customer.

Same way, Bill of supply is issued instead of Tax Invoice in case a registered person supplying exempted goods or service or both or a registered person is paying tax under composition scheme.

Important Contents in Bill of Supply under GST

Now, Let us understand the important contents in Bill of Supply as per the rules under Goods and Service Tax (GST) –

- Name, address & GSTIN of supplier

- Unique Serial No. for a financial year (not exceeding 16 characters)

- Date of issue

- Name, address & GSTIN of the recipient

- HSN code in case of goods or SAC code in case of services

- Description of goods or services

- Value of supply ( after discount, if any)

- Signature or electronic signature

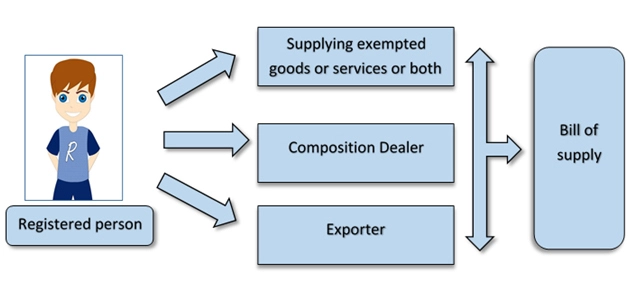

Who is required to issue bill of supply ?

Given below taxpayers are required to issue Bill of supply under Goods and Service Tax (GST)

- Supplier of Exempted goods or services – Any registered person who is supplying any goods or service which are in ambit of GST but not chargeable to tax as they are exempt. In such case, registered person issue Bill of supply as an evidence of sale instead of Tax Invoice.

- Composition Dealer – A taxpayer who is eligible for composition scheme & opting for composition scheme cannot charge GST in invoice and they are not eligible to recover the amount of tax from the customer. In such case, taxpayer is required to issue Bill of supply instead of Tax Invoice.

- Exporter – In case of export of goods or services or both, bill of supply may be issued in place of Tax invoice since export supplies are zero rated supplies. Given below details are to be mentioned on bill of supply in case of export :

-

-

- Name & address of the recipient

- Address of delivery

- Name of the destination country

-

-

Download and use GST Bill of Supply Excel Template

To use this free GST Bill of Supply excel template, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template. You can customize the currency, color scheme, fields in this excel template as per your requirement.