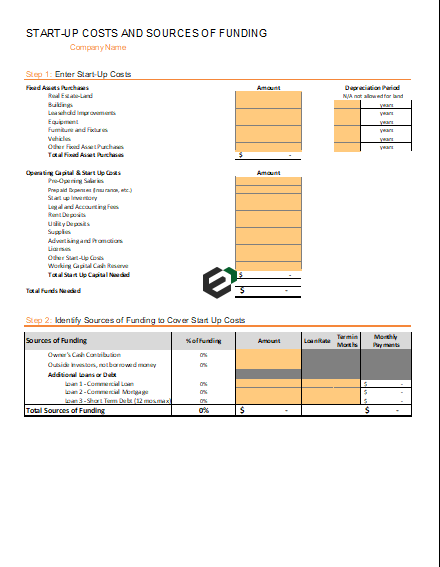

Download this easy to use and free startup financial projection template in Microsoft Excel and Spreadsheet. This is useful for business startups with Year 0 projections requirement. You can also customize and use this for your existing businesses. This financial model or projection template takes into account various accounting standards and assumptions.

Startup costs are the expenses incurred during the process of creating a new business. Pre-opening startup costs include a business plan, research expenses, borrowing costs, and expenses for technology. Post-opening startup costs include advertising, promotion, and employee expenses. (Source: Investopedia)

Importance of Financial Projections for business startups

One of the most important reasons to do a financial projection is to figure out whether or not your business will be financially viable in the short, mid, and long term. Taking the time to forecast revenue, expenses, and cash flow will show you what your financials will look like within a specific period of time.

Understanding financial projections in business

Financial projections use existing or estimated financial data to forecast your business’s future income and expenses. They often include different scenarios so you can see how changes to one aspect of your finances (such as higher sales or lower operating expenses) might affect your profitability. (Source : SCORE)

Inclusions of Financial Projections

A financial projections template usually includes a few financial statements that will help you achieve better financial performance for your business. Let us break down the components and understand each of these in detail –

a. Income Statement

Also called the Profit and Loss Statement, this focuses on your company’s expenses and revenues generated for a specific period of time. A typical income statement includes expenses, revenue, losses, and gains. The sum of all these is the net income, a measure of your company’s profitability.

b. Cash Flow Statement

Taking a look at a cash flow statement makes you understand how your company’s operations work. The statement explains in detail how much money goes in and out of your business in the form of either expense or income. This document includes the following:

-

Operating Activities

The cash flow from operating activities reports cash outflows and inflows from your company’s daily operations. This includes changes in accounts receivable, cash, inventory, accounts payable, and depreciation.

-

Investing Activities

You use the cash flows from investing activities for your company’s investments into the long-term future. This includes cash outflows for purchases of fixed assets like equipment and property and cash inflows for sales of assets.

-

Financing Activities

The financial activities in a cash flow statement show your business’ sources of cash from either banks or investors along with expenditures of cash you have paid to your shareholders. Total these at the end of each period to determine either a loss or a profit.

The cash flow statement gets connected to the income statement through net income. To make this document, it requires the reconciliation of the two documents. You can calculate net profitability or income in the income statement which you then use to start the cash flow from the operations category in your cash flow statement.

c. Balance Sheet

Balance Sheet is a statement of your business’ liabilities, assets, and capital at a specific point in time. It details the balance of expenditure and income over the preceding period. This document provides you with a general overview of your business’ financial health. Here is an overview of these components:

-

Assets

These are your business’ resources with economic value that your business owns and which you believe will provide some benefit in the future. Examples of such future benefits include reducing expenses, enhancing sales, or generating cash flow. Assets typically include inventory, property, and cash.

-

Liabilities

In general, these refer to the obligations of your business to other entities. In more common terms, these are the debts that your business incurs in your daily operations. It typically includes loans and accounts payable. You can classify liabilities either as short-term or long-term.

-

Owner’s Equity

This is the amount you have left after you have paid off your liabilities. It is usually classified as retained earnings – the sum of your net income earned minus all the dividends you have paid since the start of your business.

Together with your break-even analysis and financial statements, you can include any other document that will help explain the assumptions behind your cash flow and financial forecast template.

This template tries to include all these components. You can use this template to project the financial performance, sales expectations, operating expenditures possible for upcoming years for your business or your client’s business.

Download and use financial projection for startups excel Free template

To use this Startup financial projection template, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.