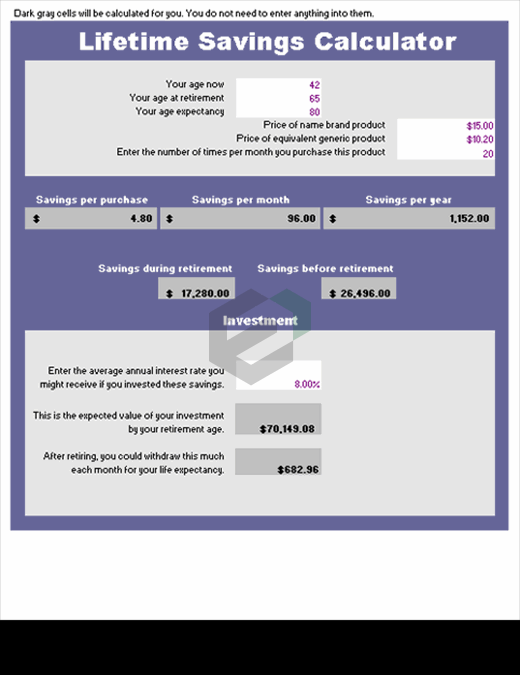

This lifetime savings calculator template determines the total wealth you can accumulate in your lifetime if you were to opt to reduce one monthly expense and invest the amount saved at a fixed rate of interest. The life savings calculator template also determines the amount that you could withdraw each month after retirement from this investment.

Reasons why saving money is important for everyone

Savings is crucial for everyone, regardless of their earnings, spending and life stage. Here are some reasons why you need to start saving.

- It offers peace of mind: Knowing that you have a certain amount accumulated for times of your need, gives you the peace of mind. You can lead a stress-free life with the knowledge that you will not have to struggle if things take an unexpected route.

- It gives you a better future: Your savings can be the answer to a number of your goals. You can buy a house, accumulate funds for your retirement, or purchase a vehicle. You can secure your future, indulge in the best of things that life has to offer and live a very fulfilling life.

- It provides for your children’s education: With a considerable amount of savings, you can fuel your children’s dreams and pay for the best schools and colleges across the world.

- You can plan your short term goals: Savings are not just aimed at the long term. You can also benefit from savings in the short term. A lot of people save for a few months and then travel.

- It gives your family security in case of an unfortunate event: By saving in a disciplined manner, you can make sure that your family is well-provided for. In unfortunate times, your savings can act as a cushion for your loved ones and help them overcome any financial difficulty.

Tips to enable savings for Individuals

If you are new to savings or find it difficult to stick to your objective of saving, then you can try the following steps.

- Limit your credit card usage: Credit cards may provide a temporary sense of relief, but the high rates of interest can deplete your savings in no time. It helps to limit your debt and restrict credit card purchases to ensure that your savings are intact and growing.

- Keep a track of your expenses: If you find it difficult to save regularly, try to record and keep a track of your monthly expenditure. This will offer you a clear picture of where you spend. You can then identify the things that are not important and aim at saving more by avoiding those purchases.

- Create a budget for savings: It helps to devise a budget for each month. You can create a plan at the beginning of the month and set limits for spending and targets saving. This lets you focus on what is important, reduces the chances of over-spending, and lets you save as planned.

- Invest in long term financial tools: When you save, it is also important to see your savings grow with time. Investing your money in a long-term investment plan can have many additional benefits. These plans offer a lucrative rate of interest that lets your money retain its value and beat inflation. One such instrument is the savings or endowment plan.

Download and use this excel template

To use this free excel template, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template. You can customize the currency, color scheme, fields in this excel template as per your requirement.