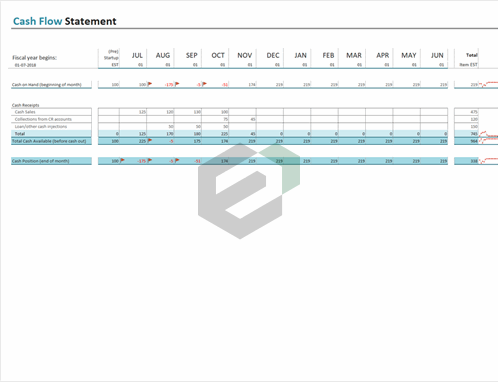

Analyze or showcase the cash flow of your business for the past twelve months with this accessible template. Sparklines, conditional formatting, and crisp design make this both useful and gorgeous.

Understanding Cash Flow Statement

As per ZOHO Blogs, A cash flow statement is an important tool used to manage finances by tracking the cash flow for an organization. This statement is one of the three key reports (with the income statement and the balance sheet) that help in determining a company’s performance.

Importance of Cash flow statement

Cash flow is important because it enables you to meet your existing financial obligations as well as plan for the future.

Yet, cash flow is a common challenge among small businesses. Around 60% of small business owners say that cash flow has been a problem for their business and with 89% of them saying these problems have had a negative impact on their business.

By balancing your inflows and outflows of cash, you can ensure the smooth day-to-day running of your business, at the same time as building sufficient reserves to weather peaks and troughs in sales, late invoice payments, or unexpected expenses.

What are the types of Cash flow statements ?

A statement of cash flow covers three main activities of your business:

- Operating activities: These are regular business activities. Inflows of cash include revenue from sales, interest and any dividends you receive. Outflows include operating expenses like wages and office costs.

- Investment activities: This refers to monies made or lost through short and long-term investments. For example, money made through the sale of assets such as land, buildings, or equipment and payments for the purchase of land, buildings, or other investment assets.

- Financing activities: This refers to raising money from debt or shares and repaying that debt. For example, inflows might be money you’ve borrowed, and outflows can be dividend payments or servicing debt.

Source : American Express

Calculating Cash flow

The net cash flow calculation of your business is the total cash received minus the total amount spent over a given time period. It includes cash received from all your business activities, including operating activities, investing activities and financial activities.

Net cash flow = net cash inflows – total cash outflows

For example, imagine a business earns £50,000 from operating activities and £10,000 from financing activities. It lost £20,000 from investments. The company’s net cash flow for the period is: £50,000 + £10,000 – £20,000 = £40,000.

Download and use cash flow statement excel template

To use this free Basic Invoice excel template, you should have Microsoft Office/ Microsoft Excel installed in your system. After installing Excel or Spreadsheet, download the zip file of this template

Extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.