Bank Reconciliation Statement is a ready-to-use template in Excel to identify the difference between checking account and Bank Book.

Update the Bank Book and enter the outstanding cheques, outstanding deposits, Bank Charges, etc. and the template will automatically display the difference.

What is A Bank Reconciliation Statement?

A Bank Reconciliation Statement is a document that compares the Bank Balance as per Bank statement and the balance as per Bank Book maintained by us.

This statement reflects the outstanding cheques, outstanding deposits, Bank Charges, etc. This document helps us to find discrepancies between our records and the bank statement.

For example, you deposit a cheque in the bank but it doesn’t reflect in receipts of the bank statement. At the time of bank reconciliation, you can easily find out.

The time frame of Bank Reconciliation depends on many factors. These factors include the size of the organization, number of bank transactions, nature of the business, etc.

You can do it weekly, fortnightly, or monthly. If you have too many transactions through the bank, then doing reconciliation weekly or fortnightly is the best option.

Purpose of Bank Reconciliation Statement

Usually, the balances as per the statement and the company’s records are not the same. This is due to deposits in transit, outstanding checks, bank charges, interest earned or paid, etc.

The main purpose of a Bank Reconciliation Statement is to identify, resolve, and properly report the difference between checking account and Bank Book.

With the large volume of bank transactions, it becomes necessary to reconcile the bank with our records. This reconciliation will assure proper recording of all bank transactions.

It is an internal financial report of business that explains and documents any differences between the bank book and our accounting records.

Steps to Prepare A Bank Reconciliation Statement

The Bank reconciliation process consists of the following 8 steps:

- Identify uncleared checks and deposits in transit.

- Add back any deposits in transit.

- Deduct any outstanding checks.

- Add notes receivables and interest earned to the balance.

- Subtract Bank Charges, interest paid, service fees, penalties, etc.

- Match it with the company’s balance. If the difference remains it means that some entries are missing to report either in Bank book or not reported in the bank statement.

- This provides you with an adjusted balance.

- The bank balance should match the adjusted balance of the Bank Book.

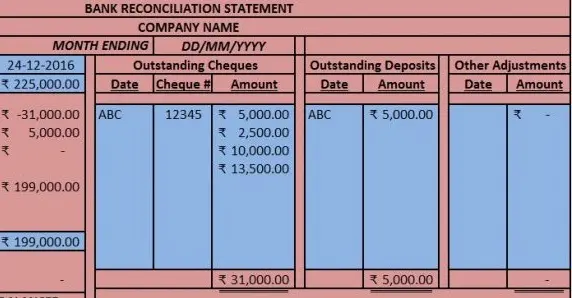

Bank Reconciliation Statement Template

We have created a Bank Reconciliation Statement along with Bank Book for simple and fast reconciliations. You can customize it according to your needs as and when required.

How to download and use Bank Reconciliation Statement free Excel template ?

To use this free Bank Reconciliation Statement free excel template, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.