Download free excel templates as per United Kingdom (UK) VAT Act for issuing an invoice for goods or services having multiple tax rates. This template for UK VAT is useful for personal and business use.

This template covers all legal compliances and legal provisions as per UK VAT Act. It is customizable as per the requirement. This template is useful to small and medium-sized businesses that don’t use any software for record-keeping.

About UK VAT Act

VAT Law in the United Kingdom (UK) is governed mainly by the Value Added Tax Act 1994 as amended by subsequent Finance Acts. But, there are many rules in Statutory Instruments. These are either orders made by the Treasury or regulations made by HMRC.

The Value-Added Tax Act provides for the taxation of the supply of goods and services and the importation of goods. This Act is applicable to all registered VAT vendors.

About Invoice in UK VAT Act

As per UK VAT Act, If you sell a customer a product or a service, you need to give them an invoice (bill) by law if both you and the customer are registered for VAT (a business to business transaction). An invoice is not the same as a receipt, which is an acknowledgement of payment. (Source : UK Government Site)

If you have commodities or supplies that have different tax rates under UK VAT Act or exempt all in one invoice, this template is the right choice for your need.

Usually, traders deal with goods and services of all kinds of VAT. Some of them are taxable and some of them are non-taxable. Such supply is called mixed supply.

For Example, In a Garment shop. Clothing of adults has standard rate (20%) applicable whereas children’s clothing is on reduce rates (5%). According to second last guideline, the rate of VAT charge per item must be shown in case the VAT applicability is different on those items.

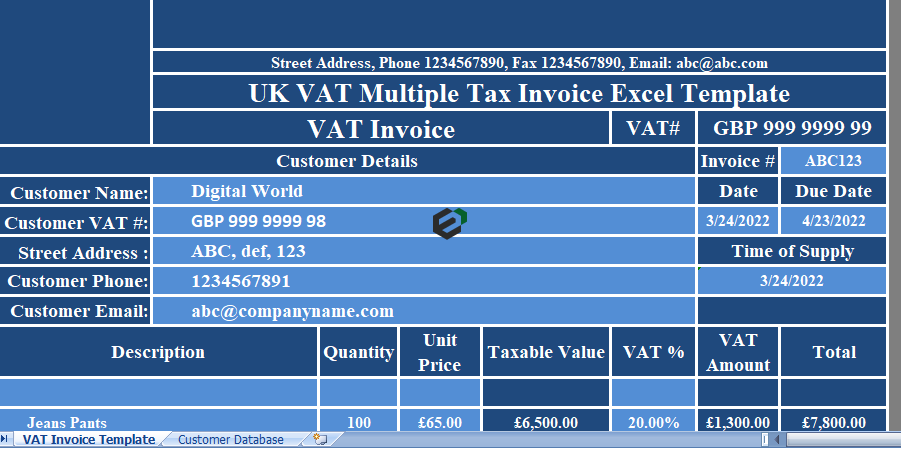

About UK VAT Invoice with Multiple Taxes Excel Template

This UK VAT Multiple Tax Invoice in Excel with predefined formulae and formatting. Business units making mix supply or supplies of goods or services or both can use template to issue an invoice to their customers.

Once you download this free excel template for UK VAT Multiple Tax Invoice template, you will see that it consists of Two major sheets, namely,

- UK VAT Multiple Tax Invoice Template and

- Customer Database Sheet.

1. Customer Database Sheet

The customer database consists of relevant details of customers like the company name, address, contact details and VAT numbers, etc. You just need to insert details once in this sheet. You can update a new customer, whenever is added to your business.

Details in Customer Database sheet is use to create a dropdown list in invoice template. Using the VLOOKUP function, when you select customer name, the invoice automatically fetches all customer information on invoice.

2. UK VAT Multiple Tax Invoice Template

This Invoice Template consists of 4 sections: The company logo, company address, VAT number, invoice title as “VAT Invoice” etc.

It is mandatory to mention your VAT Registration Number in invoice.

a. Customer Details

Moreover, The customer’s details section includes name, VAT number, address, phone number, email address, etc of your customer.

Furthermore, Select name of the supplier and it will automatically fetch details from the customer database sheet. In addition, this section on the right-hand side consists of Invoice number, Date, Time o Supply and Bill Due Date. Bill due date is set for 30 days. In case, the payment made in cash or against invoice then you need to delete data in the cell.

The Time of Supply cell automatically fetches date of the invoice assuming that invoice is issue along with the supply. If it is different then you have to enter it manually.

b. Product Details

Usually, product details consist of product description, quantity, unit price and amount. This being a multiple tax invoice, a separate column for tax percentage is given after taxable value.

The following method of calculation is used for calculating the values:

- Taxable Value = Quantity X Unit Price

- VAT Amount = Taxable Value X VAT Percentage

- Total = Taxable Value + VAT Amount

c. Invoice Summary and Other Details

However, Other details include miscellaneous items like “Amount in Words”, Terms & Conditions, Business greeting, space for company seal and authorized signatory along with invoice summary.

Total Taxable Value + Total VAT Amount – Discounts(if applicable) = Invoice Amount.

Moreover, In case of any discounts, insert the percentage of discount in the light blue cell beside discount cell. It will automatically calculate the amount of discount for you. If the discount offered is in terms of direct amount, then enter the amount manually.

Download and Use UK VAT Invoice with Multiple Taxes Format in Excel

To use this free UK VAT Invoice with Multiple Taxes Format in excel, you should have Microsoft Office/ Microsoft Excel. You can only use this template if you have these applications in your system. or Use, Google Sheets.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software. Once extracted, you can open the file using Excel and start entering data or customizing the template.