Download purchase register excel template for UAE. This purchase register template can be useful for other GCC Countries applicable under VAT Law in the Middle East. Under the UAE VAT regime, registered taxpayers need to maintain UAE VAT Purchase Register in order to calculate their Input Tax.

Requirements according to VAT Law

According to Article 54 of VAT Law, “A registered person is liable to recover input tax paid on the purchase of goods and services intended for the furtherance of business except for capital goods.”

For the purchase of raw material or buying goods for resale purpose or imports, you will pay an amount of VAT. When you make sales, you will collect the VAT on goods or services you supply. At the end of the month, you have to pay the difference between VAT paid and VAT collected.

According to Article 53 of VAT Law, “The Payable Tax for any Tax Period shall calculate as being equal to the total Output Tax payable pursuant to this Decree-Law and which has been done in Tax Period less the total Recoverable Tax by the said Taxable Person over the same Tax Period.”

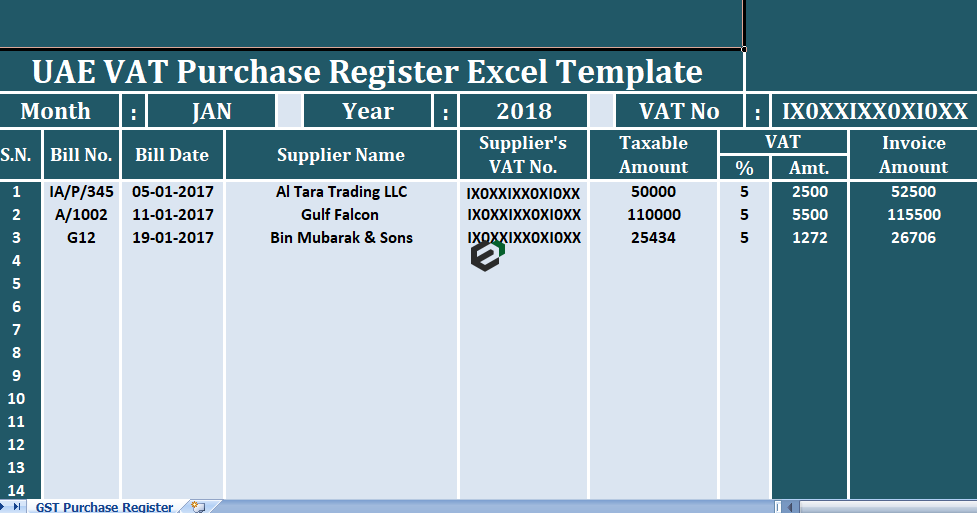

We have create an excel template for UAE VAT Purchase Register to maintain your purchase records and help you to easily calculate your input tax.

About UAE VAT Purchase Register Excel Template

Once you download this purchase register excel template, you will find 2 sections, namely,

-

- Header Section

- Purchase Details Section

1. Header Section

In the header section, the first line has your company name. secondly in the next line there is the template name.

The third line consists of Month, Year and your VAT registration number. See image below for reference:

2. Purchase Details Section

The purchase details section consists of multiple subheadings. They are as follows:

- Sr.No.: Serial number in sequence to know the number of purchase bills in any particular month.

- Bill No: the Bill/Invoice number of the consignment here series and formats of bill numbers differ from supplier to supplier.

- Bill Date: Enter the date of issue of the purchase bill.

- Supplier Name: You need to enter name of the company from which the purchase was made.

- Supplier’s VAT No.: VAT registration number of supplier. If the supplier is not register you will have to leave it blank.

- Taxable Amount: Amount on which the applicable VAT tax will be calculated.

- VAT % and Amount: You Just enter the applicable tax percentage tax of VAT and it will automatically calculate the amount. UAE has a flat rate of 5 % VAT. Hence, enter 5% in each column.

- Invoice Amount: Invoice amount = Taxable Amount + VAT Amount.

- Lastly, the total of each column at the end of the column.

Download and use UAE VAT Purchase Register Excel template

To use this free VAT Purchase Register excel template for UAE, you should have Microsoft Office/ Microsoft Excel installed in your system.

After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template. You can customize the currency, color scheme, fields in this excel template as per your requirement.