Download UAE VAT Payable Calculator in Microsoft Excel and Spreadsheet. This excel template provides you the exact payable amount of VAT to Federal Tax Authority (FTA). This template is made specifically for UAE however, it is useful for all the visitors from GCC Countries. However, little customization will be required.

About VAT Payable

To understand the concept of VAT payable, we must look into the bigger picture that initiates with Sales or Supply of goods or service or both.

When you make sales you collect VAT from customers. Credit Notes and Debit Notes issue against invoices are then adjust while calculating VAT payable.

You are entitle to recoverable VAT input on purchases use for taxable supply. So, This recoverable VAT input reduces your tax liability.

VAT Payable = Output VAT collected on Sales – Input Tax/VAT

In addition to this, as per the UAE VAT Law, you have to pay VAT under reverse charge of some conditions.

Considering all the points, this excel template for UAE VAT Payable Calculator has been designed. You just need to enter the just the taxable amount and it will automatically calculate the VAT amount along with the exact payable amount to FTA.

About UAE VAT Payable Calculator Excel Template

After downloading this Free Excel Template for VAT Payable Calculator for UAE, You will find 3 sections, namely,

- Header Section

- Calculation Section

- VAT Payment Section

1. Header Section

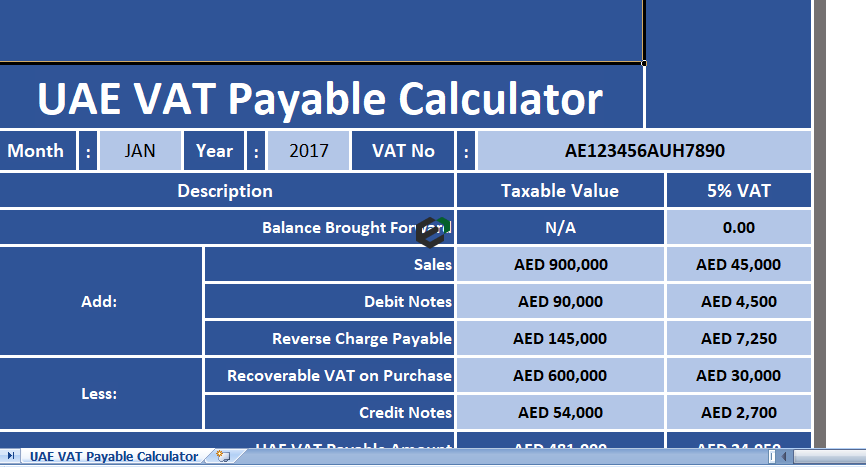

The header section consists of your company name, company logo, month, year and VAT registration number.

2.Calculation Section

Also, Calculation section consists of 3 columns. Description, Taxable value and 5% VAT amount.

Moreover, A user needs to enter amounts against each description and it will automatically calculate the applicable 5% VAT amount.

- Balance Brought Forward: If there is any previous balance of VAT payable or recoverable VAT input then it should be mention here.

- VAT payable will be a positive amount and recoverable VAT input will be always be a negative amount.

- Sales: Enter the taxable amount remaining after discounts if any in this cell.

- Debit Notes: If any debit notes are issue during the month then you will have to mention the total taxable amount of all the debit notes in cell.

- Debit notes increase your liability so it increases your taxable value.

- Reverse Charge Payable: If you have import any goods or reverse charge is applicable as per law then you have to enter the total taxable value of reverse charge in this cell.

- Recoverable VAT Input: According to UAE VAT law, a registered business is entitled to claim VAT paid on purchases used for taxable supply. Hence, you will have to enter the total taxable value of such purchases in the cell.

- Credit Notes: So, If any credit notes are issue during the month you will have to enter the total taxable value of all credit notes in the cell.

- Although, Credit notes decrease your liability as it reduces your taxable value.

- UAE VAT Payable To FTA: Taking into consideration the UAE VAT Law, the UAE VAT payable to FTA is calculated. Formula will be

UAE Vat Payable = Sales + Debit Notes + Reverse Charge Payable – Recoverable VAT Input on Purchase – Credit Notes

3. VAT Payment Section

- VAT Paid: If UAE VAT payable amount a positive amount then you need to pay that amount to FTA.

- Balance Carry Forward: Sometimes it happens that your recoverable ITC is greater than the amount payable. In such cases, UAE VAT Payable to FTA will be a negative amount.

- Such excess amount can be adjusted in preceding tax periods and thus you can carry forward that amount.

Download and use Free VAT Payable Calculator for UAE Excel Template

To use this free UAE VAT Payable Calculator excel template, you should have Microsoft Office/ Microsoft Excel installed in your system. After installing Excel or Spreadsheet, download the zip file of this template, extract the template using WinRAR or 7Zip decompressing software.

Once extracted, you can open the file using Excel and start entering data or customizing the template. You can customize the currency, color scheme, fields in this excel template as per your requirement.